How can you expect an increase in export orders given that German economy is contracting?

It appears that there is a problem. Don't you think so? Recently, 2009 growth expectations are revised downward for each of our export markets. However, business tendency survey announced by the Central Bank of the Republic of Turkey (CBRT) reveals that "expectations for export orders over the next three months" ensures rapid recovery after sinking to the lowest level in November 2008. The number of those expecting an increase in export orders over the next three months is 14 percent higher than that of those expecting a fall. As a result, real sector confidence index goes up. How can this be assessed? What is going on? Can this be the green shoot we have been waiting for?

Next week, we underlined that the relative increase in market activities must not be defined as s "green shoot". We all wish to see a permanent rally, but we don't see it. What we saw was inventory disposal operation of the enterprises sick of waiting with full inventories and thus taking risks and making sales in exchange of post-dated checks. The current movement mainly seems to be a hopelessness movement that was initiated by the business owners, which are tired of waiting and get caught by the crisis with raw material and finished goods inventories. This was what is going on according to friends from the "I am currently feeling what the figures will tell you two months from now" stance.

So, how can you respond this? You can say, "This might be what your wisenheimer friends say, but expectations surveys do not support your or their arguments at all. See the real sector confidence index? Where is the hopelessness you refer to? It seems that things are moving in the right direction." As a matter of fact, real sector confidence index derived from CBRT business tendency survey has been steadily recovering since the beginning of the year. Here, an issue we have to be curious about. If the markets have no hope, why do these expectations surveys move in the positive direction? In our consideration, there exists an extensive abnormality. Those responding to surveys concerning the future do not seem that they are well aware of what they talk about. CBRT business tendency survey used to summarize the economic activity within the country very well. Real sector confidence index used to act in a way like a pilot indicator. Is it still so?

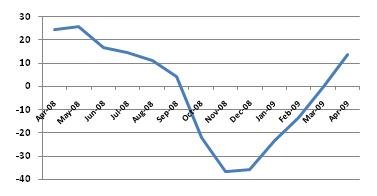

Let us do not address all aspects of this issue today. Seen as a whole, the issue is quite broad. So let us address only one aspect. "Expectation for export offers" is only one part of the real sector confidence index. Now, let us forget about the rest of the index and how it is formed, and focus solely on this part. The graph below shows that, among the participants of CBRT surveys, the number of those expecting an increase in export orders over the next three months is higher than those expecting a fall in export orders.

Graph 1: Expectations for export orders over next three months (orders will increase (%) - will decrease (%))

Now, let us add into the picture of positive expectations the following figures: Around 10 percent of Turkish exports go solely to Germany. Central Bank of Germany Bundesbank announced on April 21 that Germany, following the 2.1 percent contraction in the last quarter of 2008, must be ready for contraction at a higher level in 2009. OECD announced 5.3 percent of contraction forecast for Germany in 2009. Yesterday Baturalp Candemir from Referans daily gave in cumulative 2009 growth forecasts for twenty countries constituting 67.5 percent of the export market of Turkey. Mentioned forecasts are made by IMF. The picture that appeared was not pleasant at all. Now, under these circumstances, please tell me on the basis of which concrete data can export order expectation go up? This is the first point to touch upon.

So, what is actually going on? In our consideration, business owners bored of waiting hope that things will get better with the assumption "Things cannot get worse, business volume cannot tighten further". Thus, hopes are reflected on expectation surveys. In fact, the hopelessness of business owners about the situation prevents them from giving frosty responses. They tell what they wish to see rather than giving information on the concrete situation. This is the second point.

Let us state a third point and generalize the findings. We are going through a unique period that we are not familiar with. We are not quite sure how the economy functions in such a period. In such periods, it might be useful to be frosty in front of surveys; in particular of future expectations surveys. In a period where you handle the situation with short term decisions and where you do not know what will happen tomorrow while the course of the economy is changing, it is wise to think twice on the results of expectations surveys. It is wise not to immediately pay regard to the results of surveys in making economic policy decisions. This is the third point to make.

Then, it is wise to be frosty toward the results of all expectations surveys. It seems that if export order expectations do not give much prospective information, the same thing will be valid for real sector confidence index as a whole.

We tend to believe that in the present period, the positive movement reflected in expectations surveys does not have much of an analysis value. We would be glad to hear your opinions.

This commentary was published in Referans daily on 28.04.2009