How can Turkey improve the value added in the construction sector?

Construction services sector is among the most global sectors in Turkey. Construction companies that have been enhancing their capital structure and skills since the 1950s via public investment projects started to have a voice throughout the world along with the efforts to liberalize trade and capital accounts of the Turkish economy. Today, Turkish construction companies have a significant presence over a vast area from Argentina to Indonesia, South Africa, and Russia. Construction projects financed by the World Bank over the last decade were also predominantly undertaken by the same Turkish companies. The number of Turkish companies on the top 225 international constructors list prepared by the Engineering News Record (ENR) increased from 8 in 2003 to 31 in 2011. Turkey left behind the US, the UK, and Germany and upgraded to the second place after China.

Given the present levels of the current account deficit, the importance of construction services has been increasing gradually. However, we observe that assessments about the sector are limited to quantitative indicators such as the number of companies operating in the sector, the number of the companies in the top league or the number of countries in which construction projects were undertaken by Turkish companies. Evidently, all of the mentioned factors are important achievements. On the other hand, focusing solely on quantitative elements obstruct the visibility of problems of the sector. Available data reveals that Turkish construction companies which have operations abroad cannot undertake large-scale projects and therefore have serious scale problems vis-à-vis their rivals.

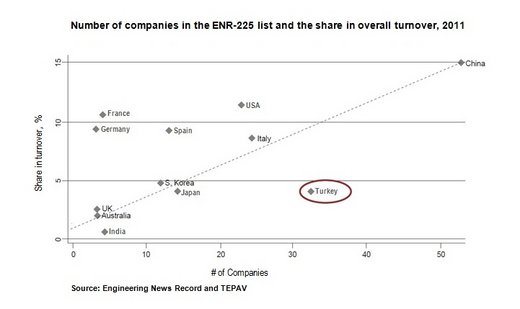

Is being the country with the second highest number of companies in the ENR-225 list enough for being successful? The ranking in terms of the total turnover of the companies on the list does not draw as bright of a picture. Although Turkey is the country with the second highest number of companies in the list, Turkish companies generate only 3.8 percent of the overall turnover of the ENR-225. The number of companies from developed countries are considerably less than that from Turkey whereas their share in the overall ENR-225 turnover more than doubles the contribution of Turkish companies. In other words, average scale of the largest Turkish construction companies is much smaller than that of those in many other countries. Turkey ranks twenty-ninth among thirty five countries considering the average scale of construction companies.

One of the main reasons that rival companies are larger-scale is that they have competitiveness in all stages of the project chain, including the design stage. Common features of large construction companies of US, Germany, France and Spain are having a strong capacity in design works and the usage of advanced technology in business processes like purchasing and planning. When it comes to the construction of complex structures like nuclear power stations, new-generation transportation projects, and industrial facilities, employer institutions prefer to work with companies which can accomplish all processes from concept design to start-up. The chances of getting the construction auctions of such projects are much higher for large construction companies in developed countries. These have relatively higher advantage for winning projects in which having the capacity to undertake all stages of the project chain is as important as the bid price.

Turkish contractors, who have a significant competitive advantage in the building phase alone, cannot perform successfully in shifting to the higher value-added phases of the project chain. Therefore, Turkey fails to have weight in the abovementioned type of projects. There are only 2 Turkish companies in the top international design contractors list of the ENR. Another indicator of the weak design capacity is that there are no Turkish companies who could compete without a foreign partner in the construction auctions of sophisticated investment projects such as the third Bosporus Bridge or Akkuyu nuclear power station.

Turkey cannot achieve the scale of large foreign construction companies without developing competitiveness in the larger value-added stages of the project chain, in design to begin with. Turkish construction companies have to add an improved capacity in higher links of the value chain to their experience and organizational skills in the building works. Along with the enrichment process, construction projects in peripheral countries will indispensably become more sophisticated. In order to be the prime contractor in these projects rather than the small construction partner or subcontractor of large companies from developed countries, it is needed to solidify the capacity of Turkish companies in all stages of the project chain, design stage to begin with.

The development of the construction services in Turkey have been concentrating solely in the building phase while Chinese companies are advancing rapidly in design activities. The share of Chinese companies in the overall turnover of the ENR-225 list increased from 6 percent in 2003 to 15 percent in 2011. Over the same period, the number of companies on the list reached from 41 to 53 and the average scale from US$165 million to US$1.1 billion. That the scale increased by almost seven times without a considerable rise in the number of companies in the list implies among others that Chinese companies managed to improve their competitiveness in all phases of the project chain. 16 out of 53 Chinese companies on the ENR-225 also made it to the top international design company list. This is also the reason why we came across frequently with Chinese companies in highly profitable and complex projects.

The private sector, universities and the public sector has to assume critical roles in order to improve international competitiveness of Turkish construction companies. To begin with, Turkish contractors should allocate more resources for enhancing their design capacity. Although they do not pay for in the short term, investments in this field are of critical importance for becoming more competitive in the long term. The primary role for universities is to advance the design pillar of engineering education in line with the needs of the private sector. The public sector should develop support mechanisms tailored for companies offering engineering services. A chief measure in this direction can be to provide a head start for domestic companies in public auctions with a design pillar. It is also of importance to take steps to encourage foreign companies to form partnerships with domestic companies in the cases where the latter do not have the technical capacity to undertake such projects. In addition, the public sector must aim at ensuring technology transfer by obliging foreign construction companies operating in Turkey to employ Turkish engineers in design offices. Otherwise, it will be challenging for Turkey to move up on the project chain and enlarge its share in international markets.