Do global imbalances decline?

Six years after the start of the global crisis, we are still busy with picking up the pieces of the world economy. Relative growth rates in developed countries, the US to begin with, are expected to recover in 2014; but the world is still performing worse than the pre-crisis period in terms of several parameters. For instance, total employment in the US is 1.3 million less than it was before the crisis, which shows us that it is yet too early to assume that the crisis is all over.

A number of “usual suspects” for the crisis are mentioned from mortgage loans to toxic derivatives. But there is global consensus that at the roots of the crisis was global imbalances. Now it is time to check if these imbalances show any trend of declining?

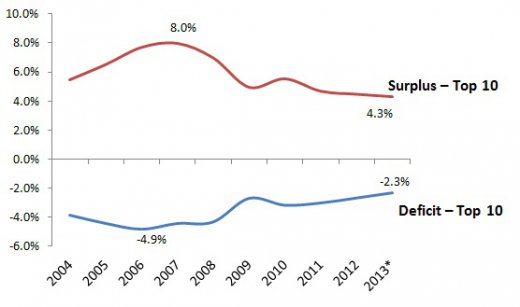

More than 80 percent of global imbalances originate from 20 countries[1] and [2]. Chart 1 shows current account balances of top 10 surplus and top 10 deficit countries of the world in proportion to their respective GDPs. According to this, current accounts have balanced significantly compared to pre-crisis period. Average surplus of the top 10 surplus countries have declined from 8% in the pre-crisis period to 4.35 as of the end of 2013 whereas deficits have eased from 5% to 2.3%. This is a favorable development for the future of the global economy, indicating that global imbalances have been declining.

Chart 1. Balancing in Top 10 Deficit and Surplus Countries (Current Account Balance/GDP, %)

Source: IMF WEO (October 2013)

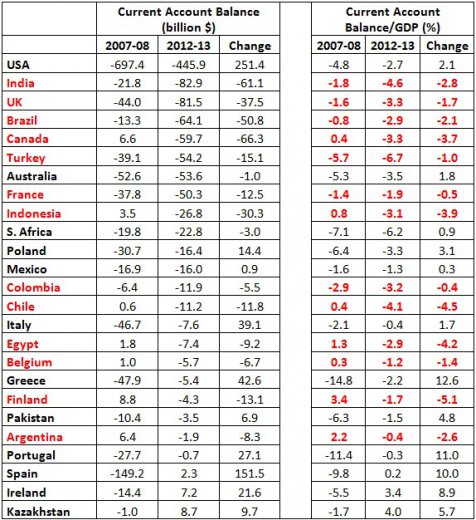

Despite the overall downwards trend, country-level statistics give us a more complex picture: while some countries have become more balances, imbalances have grown in some others. Table 1 shows 25 countries among the top 50 countries of the world as of 2007-2008 which had current account deficit problems or worsened current account balances. Among these, 12 countries have demonstrated a trend towards balancing. In fact, it is normal that deficits were in decline in Italy, Greece, Pakistan, Portugal, Spain, Ireland, and Kazakhstan, which recently suffered banking crises and/or finance problems. But it appears that the US, Australia, S. Africa, Poland, and Mexico have introduced measures to limit current account deficit in spite of the abundance of finance.

The 13 countries denoted with red are those who now have higher current account deficit to GDP ratios compared to the pre-crisis period. Please note that all of the “Fragile Five” are on the list.

Another point worth noting is that among the 10 countries which had a current account deficit of 5% or more in the 2007-2008 period, Turkey is the only one which was unable to reduce its deficit ratio. In fact, the current account deficit to GDP ratio has increased from 5.7% to 6.7% (2012-2013 average). This is of critical importance for understanding the recent exchange rate developments.

Table 1. Performances of 25 deficit countries

Source: IMF WEO (October 2013)

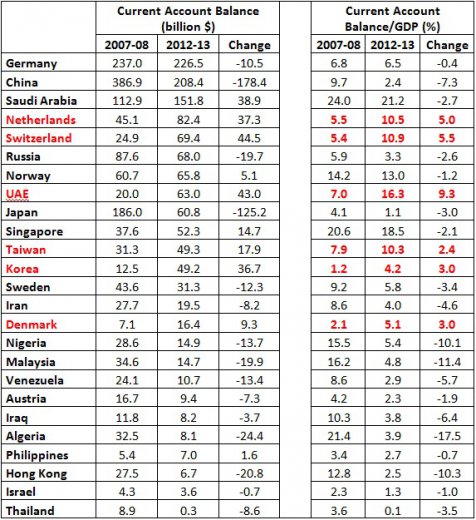

We see a rather consistent picture when we look at the performance of top 25 surplus countries: 19 countries have contributed to global balancing with declined surpluses. The position of China is especially noteworthy: thanks to its recent policies for balancing, China is no longer the highest surplus country. The six countries denoted with red have increased their current account surplus over the studied period.

Table 2. Performances of 25 surplus countries

Source: IMF WEO (October 2013)

It is seen that global imbalances have eased significantly compared to the period before the crisis. The US as the top deficit country and China as the top surplus country played the major role in the rebalancing process. At the country level, an important portion of the deficit countries were unable to reverse their position, which poses a risk to the global economy. These countries should act with caution over their current account balances given that global liquidity is expected to shrink in the period ahead.

[1] The top 10 surplus countries (Surplus – Top 10) are China, Germany, Japan, Saudi Arabia, Russia, Netherlands, Norway, Singapore, Sweden, and Switzerland (by 2007-2008 current account balance average)

[2] The top 10 deficit countries (Deficit – Top 10) are the US, Spain, the UK, Australia, Greece, Turkey, Italy, Poland, France, and Portugal (by 2007-2008 current account balance average)

*Sarp Kalkan, Economic Studies, Analyst

*This article was published in Turkish on 08.01.2014