The EU Progress Report and Fiscal Transparency

As you know, the EU progress report was released last week. It may have escaped your attention in the report but it would seem that fiscal policy is not on the EU’s radar all that much. It would be understandable if it wasn’t. No immediate problems strike the eye in the budgetary balance and the debt stock in terms of fiscal discipline. In a section consisting of a single paragraph, it says a) that the annual budget is drafted as a part of the medium-term budgetary framework, b) that fiscal discipline is maintained despite the lack of a Fiscal Council and c) that the budgetary transparency is adequate. The only criticism is that revolving funds remain outside the budgetary process.

I believe this report would fail to satisfy even if it was one of those periodical reports sent by investment banks to their clients. It becomes even graver considering that it comes from a multi-national union that we stand for economic and political integration in the future. The perspective of the report is, in my point of view, quite superficial, even fallacious.

For one, it is hard to say that the annual budget is drafted as a part of the medium-term budgetary framework. Our medium-term program is released in October. Public bodies prepare their budget proposals and submit it to the Ministry of Finance before that. Therefore it is impossible for the fiscal policy to become part of a medium-term strategy. Furthermore, the degree to which our medium-term program is strategic remains questionable. The medium-term program released each year looks more like a list of new targets and measures set from scratch. It never discusses the achievement level of the targets and policies set in the past, and the impact of the policies that have or haven’t been put in place. This time around, to top it all, the national income figures used were changed. Hence, a problem of credibility compounded the lack of strategy and analysis.

All this despite the fact that the EU law requires member countries to formulate their macroeconomic and fiscal strategies for the next three years by April 30th at the latest, in line with the process named the “EU Semester.” They first have to set a medium-term fiscal target, identified on the basis of the structural budget balance (i.e. the balance net of the cyclical fluctuations of the economy as well as of one-off, temporary revenues and expenditures). Afterwards, the base year budgetary figures (the rate of current revenues and expenditures to the GDP in the absence of any policy change) are calculated, the measures and policies to be implemented in the forthcoming term priced, and the impact on the base year assessed. These targets and policies are debated, refined and updated in the budgetary process, converted into the medium-term budget framework by mid-October and submitted to the national parliaments along with the budgetary proposal. If there are concerns over excessive deficits or deviations from the medium-term fiscal targets, the European Commission can intervene at any stage and ask for corrections. Furthermore, these countries have independent “fiscal councils” in place. These monitor the consistency of the targets as well as the process regarding compliance with fiscal rule, and inform both the public and the parliament.

One could say at this point: “But the EU has just experienced its most costly and most profound debt crisis ever; indeed, even continues to do so. It would hence be less than extraordinary for them to keep a tight grip on things; whereas we don’t have a debt problem.” This is partially true, but quite a superficial consolation, in my opinion. For starters, wouldn’t it be wise to strengthen the institutional setup while everything is on track? If the fiscal rules and institutional regulations sought to be established today had been in place before 2009, perhaps the EU debt crisis could have been prevented. Furthermore, I don’t think it is a good guarantee in terms of fiscal sustainability if the public debt is not too high. God forbid, but in the event of a financial crisis we’ve all witnessed just recently how the private sector debt sneaks into public balance sheets, both in the US and the EU. Could we say that Turkey, with its increasingly sluggish savings rates and its seriously ailing balance of payments, faces no such risk whatsoever?

But the medium-term budgetary process, and the fiscal rules and fiscal councilss in particular, could be the subject matter of another article. Let’s just leave them aside for the time being to come back to later on. I think the most problematic diagnoses of the EU progress report are those pertaining to fiscal transparency.

I believe that the conviction on transparency is based on a faulty consideration altogether: The progress report says that the “annual report” submitted to parliament is equipped with full information and has been submitted to parliament in due time. As you’d well know, the law (nr. 5018, art. 18) requires the submission of a report called the “annual economic report” (as well as other reports) to parliament along with the budgetary draft. (https://www.maliye.gov.tr/Documents/Y%C4%B1ll%C4%B1k%20Ekonomik%20Report%202015.pdf )

As the link above indicates, the report is in fact a compilation of various economic data issued periodically by the Development Ministry, i.e. the former State Planning Organization. It is a useful report in essence, but it does not reveal a story on the fiscal policy with the data it features, nor does it associate fiscal policy with the other economic policies.

Another report submitted to Parliament along with the budget draft is the budget justification. This I think is a report more focused on fiscal policy, or more policy-oriented in general. But this report also suffers similar problems. (http://www.bumko.gov.tr/Eklenti/8600,2015yilibutcegerekcesi.pdf?0)

The analytical framework here is unsatisfactory. Besides, the scope is rather constrained, it’s often engaged in assessments on the basis of the general budget, and sometimes the central administration budget. Local administrations are absent altogether, whereas social security is also scant. The indicators rely on budget deficits and primary deficits, which have lost value of use by now. Using indicators more relevant to economic policy, such as structural deficits, would have been more worthwhile. A series of fiscal measures are cited, but there is no reference to whether they will be carried out as a consistent whole, and to what macro fiscal ends. None of these measures have been costed and the base year effect has not been assessed. As I pointed out in my previous essay, there is almost nothing on which priorities of the government have merited the allocation of available resources, as we do not prepare, implement or monitor the budget in the form of goal-oriented “programs”.

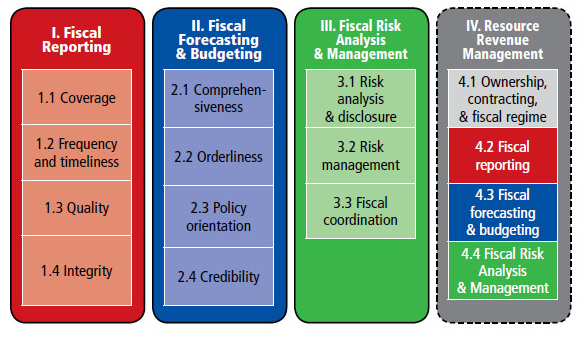

Could we say now based on these reports that fiscal transparency is satisfactory? Absolutely not, in my opinion. According to the code devised by the IMF, which sets the standards on transparency, fiscal transparency comprises of four pillars as you can see from the figure below:

As you can see, fiscal reporting is only one of the four components of transparency. Moreover, along with indicators like the “coverage” and “periodicity and timeliness,” the “quality” and “integrity” of the reports are also relevant assessment criteria. Therefore, the EU progress report seems to have reached its verdict by relying on an assessment criteria that corresponds to some 10% of the international transparency standards.

As I noted in my previous commentary, the IMF sent a delegation to Turkey this year for fiscal transparency and will hopefully publish its assessment shortly. In the meantime, though, I’d like to submit to your attention a report on fiscal transparency issued very recently. A think-tank named the International Budget Partnership has been evaluating the fiscal policies of countries against the benchmark of good governance principles. Turkey has scored 44 over 100 in budget transparency, 21 over 100 in the civil participation in the budget process, 17 over 100 in terms of the supervision of the budget by the legislature within the framework of the assessment made in the “transparent budget report” drafted for 2015 and released last month (http://internationalbudget.org/opening-budgets/open-budget-initiative/open-budget-survey/country-info/?country=tr ). These scores are in parallel with the “fiscal transparency” reports issued by TEPAV a while ago (www.tepav.org.tr).

It is therefore impossible to get a realistic idea on the current outlook of fiscal policy based on the EU progress report.

International Monetary Fund, Pillars of Fiscal Transparency Standards

(The fourth of these pillars, framed in a dashed line, is still being developed and hence its details are still missing.)