Commentaries

Fatih Özatay, PhD - [Archive]

The CB’s hands are clean 27/09/2012 - Viewed 1772 times

It seems we will be searching who did wrong as we are keenly interested in identifying wrongdoings and wrongdoers.

With the economic growth in the first quarter slipping to 3.1 percent, some circles blamed it on the Central Bank (CB). But, there is no wrongdoing in this case. Even if there was, the CB was not who did wrong.

The “wild” increase in credit supply during the last seven months of 2010 and the first seven months of 2011 was a threat to financial stability. Research suggests that almost half of all financial crises were preceded by rapid credit expansion. The main reason why rapid credit expansion and financial crises are closely and dangerously correlated is simple, I guess: in times of rapid economic growth, economic actors tend to be highly optimistic.

Supply and demand boosts

The delusion that everything will be perfect forever boosts credit demand with a desire to accelerate investment and consumption expenditures. People tend to spend recklessly as they don’t consider the risk that things might turn around. Lenders, also caught by the same delusion, make effort to extend their share in the growing credit market by raising their supply. They don’t evaluate loan applicants and loan conditions as thoroughly as they used to. Of course, this type of behavior does not apply for all borrowers and lenders; but a significant part acts like this, making the economy highly vulnerable to crises.

Please let me note that the latest “wild” increase in credit demand in Turkey was triggered mainly by generous capitalization in the US and extremely low levels of interest rate in developed countries. The liquidity, in search of profits, was invested in gold and in countries like Turkey. Since 2010, risk appetite has the potential to make a 180 degree turn in a day. Therefore, the risk that rapid foreign fund inflows suddenly halt brings about the risk of a collapse in credit supply as well as of failure to repay debt and make new borrowing. These all have the potential to affect the economy adversely.

The CB played a supporting role

On valid grounds, the economy management wanted to stop the dangerous course of credit supply. First, the CB stepped in. Due to reasons I addressed on this column several times and re-handled with a series early this year, the CB’s measures ran into the ground. When the Banking Regulation and Supervision Agency (BRSA) stepped up after the elections in July 2011 and risk appetite started to decrease due to the intensification of the turmoil in Europe, credit supply and credit demand turned down. This was facilitated by a significant rise in interest rates introduced by the CB by the end of the year. Therefore, if there was a wrongdoing, BRSA and Europe were who did wrong. The CB had a supporting role, at most.

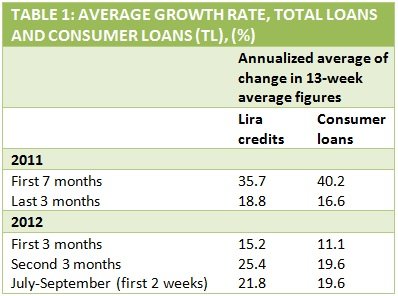

Average credit supply growth in the last quarter of 2011 was significantly lower compared to the first seven months of the year. The slowdown continued in the first quarter of 2012. In April, credit supply started to revive: average credit supply growth rate in the second quarter was substantially higher compared to the previous six months. Nevertheless, recent data suggest that this trend has ended (Table 1). With the ongoing risks, this downturn might continue. And this is bad news for the growth performance in the next six months. It seems we will be searching who did wrong as we are keenly interested in identifying wrongdoings and wrongdoers.

This commentary was published in Radikal daily on 27.09.2012