Headwinds require more transparency

If you are flying a plane, headwinds are a bad thing. According to one pilot manual, “they slow you down and require that you use more fuel to get to your destination.” That’s what I see in Ankara today, regarding the course correction of the economy. Headwinds are slowing down the process and increasing its cost.

It has been about a month that we have had a sharp shift in economic leadership in Turkey. We now have a new economy minister and a new central bank governor. Yet the question remains: is the change in Ankara real and here to stay, or just window dressing? Are we back to sound economic policy or just buying time? If the lingering doubts are to be squashed, words won’t cut it. We need quick action.

If you take the long view, this country has increased its global competitiveness twice in recent memory. The first was in the 1980s and the second was in the early 2000s. In both cases, Turkey tamed the public sector with more transparency. Now is the time to focus once again on more transparency, and fully commit to the course correction.

There are three areas we need to look at in particular.

First, Turkey needs more transparency in Central Bank accounts. Reserve management policy – or what may be called the gimmicks of the last two years – have to be dragged out into daylight. It is easy to do, if one is serious. How Turkey has lost so much of its reserves just to keep the exchange rate has to be known in all of its details.

Second, the extent of contingent budget liabilities arising from public-private partnership (PPP) projects need to become transparent. The figures are already there, and now is the time to be open with them. The issue of fiscal space is significant in dealing with both COVID-19 and also designing a way out from this pandemic-induced mess. As the vaccine is going to gradually get us back to normal, we should use the opportunity to chart a path into the future.

Third, Turkey needs transparency regarding possible future contingent liabilities. What does this entail? For starters, a credible and transparent stress test of Turkish banks. There is a lot of talk about the rapid depreciation of the lira and the mounting debts of the corporate sector. This is bad for banks and not useful for financial sector stability. The only way we can get past it is to take a hard look at Turkey’s banks and build their credibility.

As far as I can see, if there is really a will, there is a way. None of this requires any additional regulations, laws or constitutional amendments. All we need are a couple of administrative decisions.

Transparency might be hard at first, and could trigger some scandalous press, but it is the only way to convince non-believers that Turkey is in a genuine process of course correction. It will allow us to cope with CDS risk premiums (which remain high) and the higher cost of borrowing, both of which are critical.

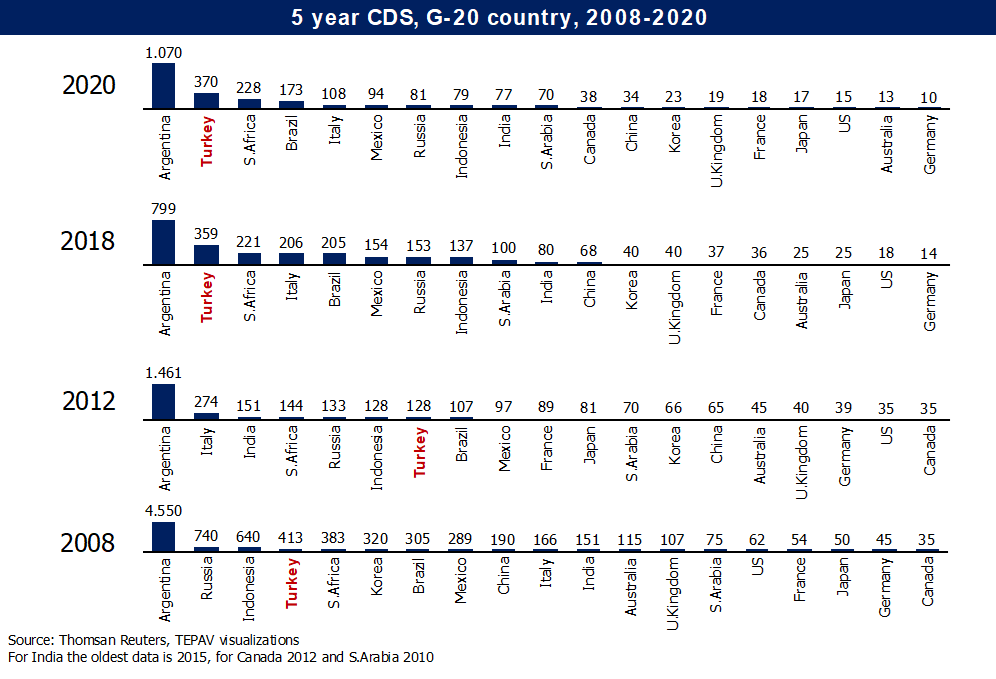

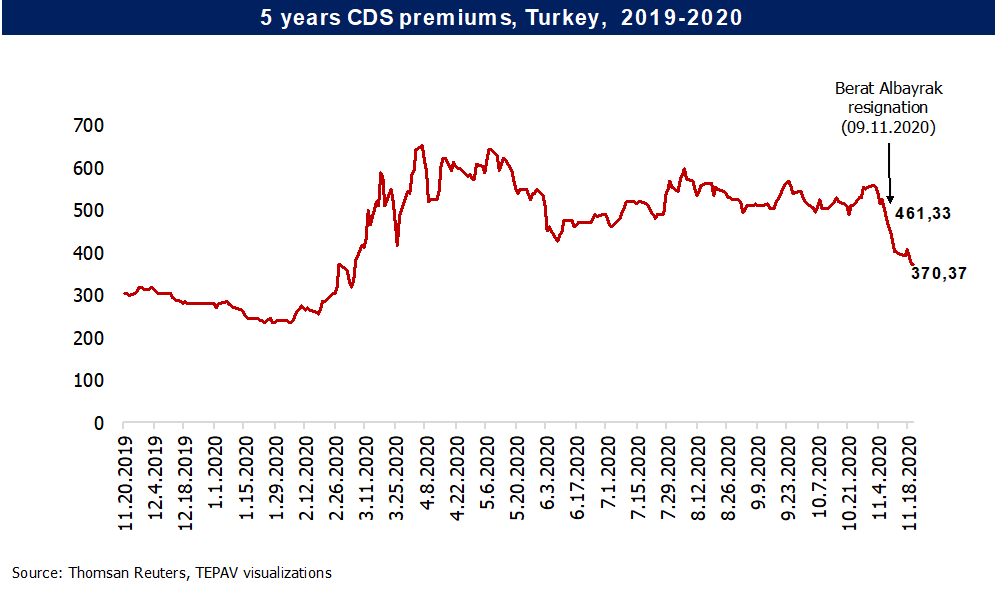

Note that Turkey’s risk premium has already declined from 461 to 370 after the resignation of you-know-who. Still, the country has the second-highest risk premium in the G20, after Argentina. A high CDS risk premium is like paying high insurance premium to invest in Turkish assets.

As we fly our new course, the new pilots of the economy need to cut through the headwinds. This is very easy to do, all they need is political backup and a free hand. That is the only way Turkey can get through headwinds, and get back to a horizon of prosperity.