Why is Turkey’s export performance going down the drain?

G20 Antalya Summit is now over. The G20 Circus has hit the road from Antalya to Hangzhou in China. The next performance is due in November 2016. The G20 offers a good opportunity to follow up on the global agenda. Never mind those commentators who say that ISIS has become the top item in the global agenda. ISIS was just the current affairs flavor of the global agenda debates this year. It simply served the purpose of salt, pepper or paprika in a dish. In fact, the global agenda is much more extensive and more comprehensive than ISIS. The slowdown in world trade constitutes one of the important issues in the global agenda nowadays, which, obviously, affects Turkey as well. Our exports go downhill, according to dollar-based statistics. Let’s take a closer look at the figures today.

A systematic change becomes evident in world trade figures if you compare them on pre-crisis and post-crisis terms. The annual growth rate of the world trade in the 2012-2014 period staggers around 3 percent, whereas it stood at an annual average of 7.1% in the 1987-2007 interval. The figures are from an IMF study of January 2015. Those who take an interest can look it up on the internet with the following keywords: “The Global Trade Slowdown: Cyclical or Structural?”

The world trade has started to slow down following the crisis. In fact, its growth rate has dwindled by half. Once, the growth of the world trade used to exceed the global growth rate. Now it’s the opposite. The growth rate of the global trade remains below the global growth rate. As every change is unnerving, this too gets on the nerves of analysts.

And where does this trend come from. This is the point where accounts differ. All these accounts were always the topic of the T20 meetings, the official and unofficial preparations made ahead of the G20 Antalya summit. I observe three different efforts to account for the developments on the table.

The first concerns protectionism that has increased directly in parallel with the crisis. In a period when the domestic markets of developing countries gain significance, rising protectionist tendencies in various countries may have led to such an outcome. Everyone may be seeking to save their markets to themselves. I am not sure, however, whether there is a causal relationship involved, even though there is obviously a correlation.

Second, the increased importance of global value chains may have led to this outcome. In a way, this implies that the way we do business around the world has changed. Yesterday was an era of transnational goods. Production would be carried out somewhere, and the products would be distributed around the globe. Today, we are in the age of transnational factories. Production is carried out around the globe, while the products remain to be marketed at a specific location. What we see here is a phenomenon that renders the World Trade Organization pointless, and the up and coming regional trade agreements relevant. It is not for nothing that the TPP and the TTIP are emerging.

According to the third explanation, the drop in global commodity prices may be what is slowing down the global trade growth. The sliding revenues of countries that produce raw materials may be, in the short run, suppressing the import demand of these countries. The downward trend in raw material prices, in turn, appears to be related directly to the anticipations of a rise in interest rates. Everyone seeks to hold on to liquidity in order to make the best of the investments opportunities to arise once interest rates rise. What do we see? Now, there are bonds. Then interest rates will rise. What matters these days is to extract the wealth that awaits under the ground as soon as possible and hold on to cash instead. The truth is, I believe this is the best explanation for this short-term phenomenon.

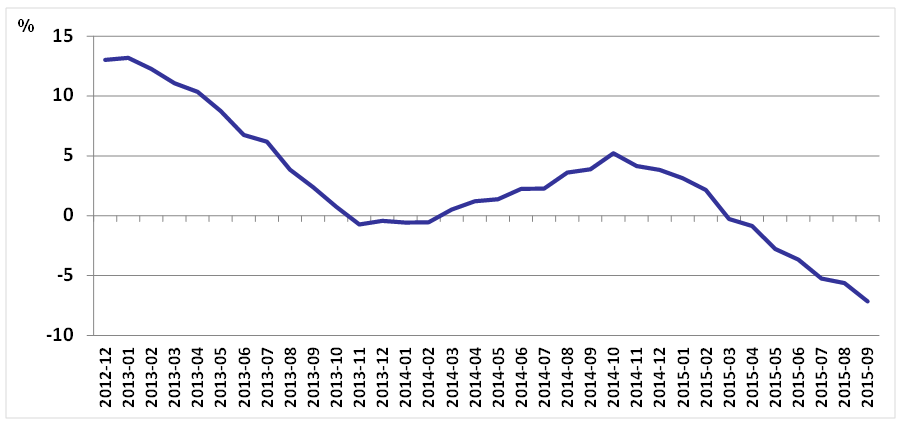

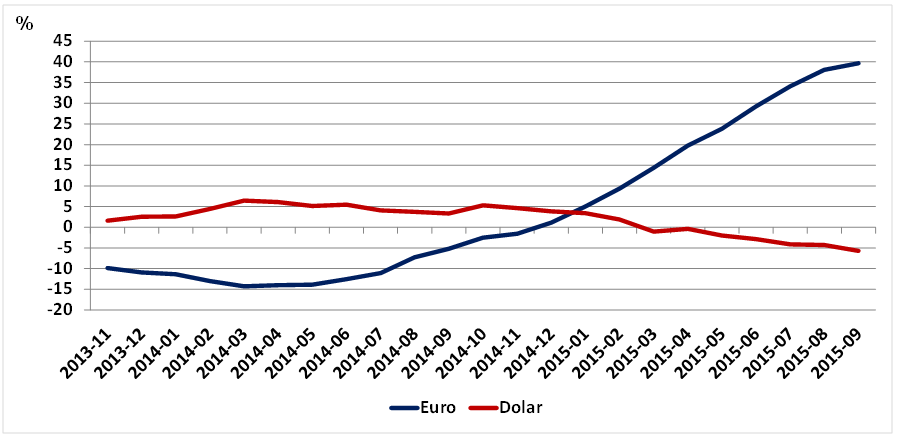

Now please take a look at these two graphs. The growth rate of Turkey’s imports also slows down from 2012 to 2014. This is the first graph. Now let’s consider the second, and the more striking one. Turkey’s exports in euro terms don’t drop from 2012 to 2014. To the contrary, they are rising. What is it that’s dropping? Turkey’s exports in dollar terms. What’s the idea? Turkey’s exports consist of two parts: The euro-based export figures consisting of goods sold to the European market and the dollar-based export figures composed of goods sold to markets outside Europe. TurkStat announces export data by currency type with their dollar equivalents. As the euro depreciates against the dollar, you may expect a drop in the dollar equivalent of the exports in euro terms. But that’s not the case. Let’s make that point first.

But Turkey’s exports in dollar denomination drops in the 2012-2014 period. What do we have here? Our exports to oil-exporting countries like Russia, Iran or Saudi Arabia. One third of Turkey’s exports were destined for oil-producing countries. I remember having written that before. Now our exports are faltering precisely from that point.

Turkey must start to learn how to extend its export span and have easier access to the domestic markets of other countries. I believe that China’s One Belt, One Road project is significant in this framework. The Silk Road approach is in fact of strategic significance. This is the first time we witness a project where the infrastructure, rather the terms of trade is brought to the roundtable. It is the hardware, rather than the software of trade that is being discussed.

Turkey must rescue the debates on its export strategy from the local currency vs. interest rates conundrum. We are headed towards times when a country that does not host parts of the global value chains will not be able to boost its export performance in a systematic manner. In an era when the infrastructure of trade will be restructured, Turkey must start having dreams about Asia. But what do the Turks, clueless about the global agenda, do instead? They say, “It won’t work until our interest rates come down.” Just like the fish, unaware of the sea they swim in…

Graph 1: Total exports (12-mo cumulative, y-o-y, %) (Dec 2012 – Sep 2015)

Source: TurkStat, TEPAV calculations

Graph 2: Exports by currency type (12-mo cumulative, y-o-y, %) (Nov 2013 - Sep 2015)

Source: TurkStat, TEPAV calculations

P.S.: TurkStat announces exports by currency types in terms of their dollar equivalent. The euro curve in the graph demonstrates the exports made in euro denomination in terms of their euro equivalent.