Inflation rate: heads to where?

Together with the rise in crude oil and food prices, the possibility of an upwards movement in inflation rate becomes more visible.

Consumer price indices have been issued since January 1964 though under different names. I broadly reviewed the year-on-year change in the price index for each month: 4.2 percent inflation rate announced for February 2011 is the lowest inflation rate since mid-1970s.

Nevertheless, nobody including the CBRT (Central Bank of the Republic of Turkey) expects that the rate will remain at low levels. Inflation target for the end of 2011 is around 5.5 percent. However, in the latest inflation report the CBRT foresaw that the year-end inflation rate will stand between 4.5 percent and 7.3 percent. The mid-point of this large interval is 5.9 percent. To put it differently, inflation rate is estimated to be realized slightly above the target.

Estimates might be exceeded

The available information suggests that the inflation rate is most likely to remain above the level estimated by the CBRT. To begin with, the CBRT assumes that the barrel price of crude oil will be US$95 in average. This is a higher level than that estimated in the previous inflation report. Nonetheless, barrel price of crude oil is much higher currently. Barrel price of the Brendt oil was US$115.9 while I was writing these lines. Of course the change in the oil prices is closely related with the developments in the Middle East, but there exist certain risks at the current state. Similarly, food prices have tended upwards which constitutes another source of risk for inflation.

I want to emphasize two points with respect to the inflation rate figures announced on Wednesday. First, the headline inflation calculated with the I index that the CBRT attaches special importance to has been increasing since October. I have severe doubts about the success of the l index in calculating the headline inflation as I have underlined several times before; but after all the CBRT attaches importance to this indicator.

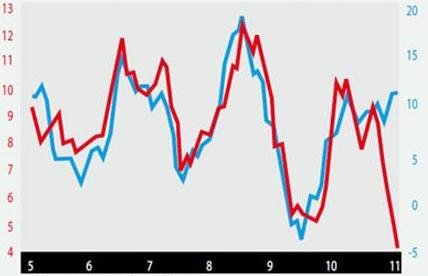

Consumer and producer price indices

PPI is highly volatile

The second point I want to stress is about the producer price inflation (PPI). We already know that the PPI is highly volatile. Therefore, the level of the PPI in a particular month is of no importance. On the other hand, the change in the PPI over time is of significance.

The figure above shows the changes in the consumer and producer price indices since the beginning of 2005. As you might note, the figures on the left and right axis (the figures for consumer and producer indices, respectively) are different. The PPI figures are higher both above and below zero; that is PPI is more volatile. On the other hand, both figures move in the same direction until August 2010. After this point, consumer price index decreases rapidly whereas producer price index increases slightly (or at least it does not tend downwards). When considered together with the rise in crude oil and food prices, the possibility of an upwards movement in inflation rate becomes more visible.

This commentary was published in Radikal daily on 05.03.2011