Preventing evaporation: What to do?

I believe that to ease the heating up, the fiscal policy should be tightened.

Let me begin with a thesis that I cannot understand. There are some who think that when you say the economy has heated up, you imply that the Central Bank (CBT) has to increase the interest rates. Is this the only conclusion to be drawn from the heating up argument?

I think, under the current circumstances, the CBT should not increase the interest rate. On the other hand, I am of the belief that the economy has heated up. If the circumstances change and the inflation rate shows a clear upwards trend, raising the interest rate might be useful. However, I do not think that it will be of any use under the current milieu. In fact, it might further the short term capital inflows and contribute to the heating up of the economy.

I think, to ease the heating up, the fiscal policy should be tightened. Moreover, the Banking Regulation and Supervision Agency should take stronger steps to limit the rapid credit expansion. In this context, I argue that it will be useful to define a ceiling for banks' weekly borrowing from the CBT. I am of the belief that, measures to limit short term capital inflows can then be introduced.

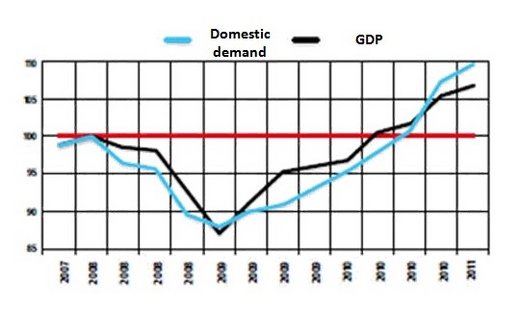

The heating up debate stems to some extend from the vagueness of the concept. Heating up should be associated with domestic demand rather than with gross domestic product (GDP). Domestic demand is the sum of private and public consumption expenditures and private and public investment expenditures. It includes the goods imported to meet domestic demand but excludes exports. Therefore, to obtain the GDP (the demand for domestic production), you should add exports to and subtract imports from domestic demand. Figure 1 below shows the changes in the both variables from the last quarter of 2007 to present. I would like to stress the considerable widening in the difference between domestic demand and GDP in the last two quarters.

In periods in which domestic demand expands rapidly, the two indicators are disturbed (unless the other elements affecting the mentioned to indicators does not work to offset it): inflation and current account deficit. In this context, the fact that the inflation rate is not disturbed does not necessarily mean that the economy has not heated up. If variables working in the other direction eliminate the upwards pressure on inflation caused by rapid expansion in domestic demand, the inflation might remain unchanged despite the heating up. On the other hand, the heating up of the economy might lead to an increase in current account deficit, especially the deficit adjusted to the changes in the energy prices. Apparently, the exact opposite also holds, in which current account deficit is not affected but inflation rate is pushed upward. Or, both might increase.

In an economy in which domestic demand increases rapidly, one can also expect that inflation rate increases eventually. But this "eventual" movement might take some time. For instance, exchange rate might decrease due to large foreign exchange (FX) inflows. At the same time, if the prices of critical imported inputs remain constant or decrease, the pressure of domestic demand putting prices up might be mitigated.

In this context, high current account deficit - row and adjusted to the change in energy prices - is a significant indicator of the heating up of the economy. Stressing this fact and calling for the initiation of required measures does not imply that I ignore that current account deficit is a structural challenge for Turkey and that it could be overcome only in the medium- or long-term. But, if the patient is suffering from gastric bleeding, the doctor first tries to stop the bleeding. It is a later concern to identify and eliminate the causes of bleeding.

Figure 1: GDP and domestic demand, 2007Q4-2011Q1 (2008Q1 = 100, seasonally adjusted)

Source: TURKSTAT

This commentary was published in Radikal daily on 16.07.2011