Turkey has budgetary problems

Countries that have control of their budgets can stem the current while those that fail to control their budgets go adrift.

You cannot treat a disease you cannot diagnose. Turkey has a public finance problem. It has budgetary problems. That yesterday's indicators do not say so does not mean that there is no problem. It is necessary to assess the circumstances cautiously from a new perspective. Turkey gained a great deal after the 2001 crisis. Now, the risk of losing those gains grows with each day. At least, this is what I think. Let me tell you why.

There are two types of countries when it comes to fiscal policies: those that can stem the current since they have control of their budgets and those that go adrift since they don't. The countries in the first group can respond to changing circumstances by raising public expenditures/savings via expansionary/contractionary fiscal policy in times of market contraction/expansion. The countries in the second group, however, fail to increase/decrease expenditures in response to a fall/increase in revenues. Those in the first group are active and can manage their budgets. The countries of the latter group fail to manage their budgets. Turkey increasingly has taken a position in the second group. The present era is one in which developing countries can upgrade from Mickey Mouse states to developed countries that can introduce budgetary policies to fight against the tide. Many Latin American countries from Chile to Brazil have initiated modern public finance techniques recently. Turkey also started to modernize after the 2001 crisis. However, the present picture reveals the fact that old diseases recur. This is bad.

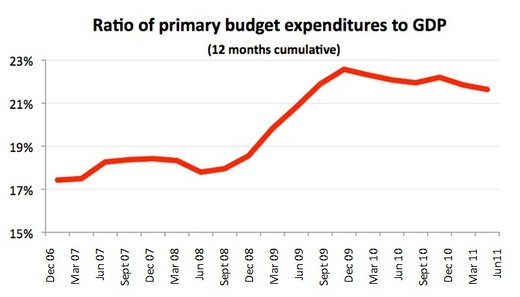

The first indicator of a budgetary problem in Turkey is related to the trend of the share of the primary budget expenditures in the national income. This trend is displayed in the graph below. From the end of 2008 to the end of 2009, the mentioned share increased approximately by 35 percent. Turkey first avoided taking budgetary measures upon the belief that the global crisis would not hit it. It lost time and made a mistake. Though delayed, it substantially increased the primary budget expenditures at the end of 2008. It introduced an expansionary budgetary policy in response to the crisis. Since the measures were delayed, however, the economy contracted severely in 2008 and 2009. It recovered rapidly in 2010 with the help of expansionary policies. This process of rapid recovery brought a record-high current account deficit. The circumstances have changed; however, public expenditures have not decreased. This is what I understand from the graph below.

Now the second indicator, which is addressed in a study by the Central Bank of Turkey titled "Structural Budget Balance and Fiscal Stance in Turkey." Cem Çebi and Ümit Özlale demonstrate that the fiscal policy stance of Turkey was against the tide in 2009, was pro-cyclical, that is, adrift in 2007 and was neutral, that is, inert, in 2008 and 2010. I believe that this is evidence of the fact that the budget is not managed taking into account the macroeconomic framework. The change in the level of expenditures in contradiction with the change in the circumstances as shown in the graph validates this claim.

Turkey's fiscal and monetary policies do not regard the conjuncture.

The CBT decision declared yesterday signals a growing gap in this regard.

The attitude to "let the economy stew in its own juice" is becoming more widespread.

Uncle Karl used to say: "I have spoken and saved my soul."

This commentary was published in Radikal daily on 05.08.2011