Where will the exchange rate head?

The economy has accumulated risks during the process of uncontrolled growth. The exchange rate adjustment is seen as a remedy to this problem.

It appears that the festive holiday break of the exchange rate adjustment has ended. We have been watching the exchange rate movements since the beginning of the week. Okay, the external circumstances are chaotic and the increase in the dollar exchange rate stems to a large extent from the euro/dollar parity. However, the impact of such chaos did not use to be like this. The Turkish Lira did not depreciate as such, but even appreciated slightly. Exchange rates tended to remain constant over a long time. No one used to talk so frequently about dollarization. For the first time since 2001, entrepreneurs had started to borrow in dollar terms with the aim to reduce costs. Now the opposite is happening. In the past, the Central Bank of Turkey (CBT) did not make statements like, “The exchange rate will contribute to the rebalancing of domestic and foreign demand.” Now it does. The Monetary Policy Committee stresses that exchange rate adjustment is a favorable factor thanks to its contribution to the cooling down of the economy. So, what is different today from the past? What is the CBT implying? I personally think that this mobility is associated with the statements by the CBT.

Have you read How to Travel with a Salmon, a compilation of Umberto Eco’s newspaper articles? One of the essays I cannot forget was on missing the first act of a play and watching it from the beginning of the second act. Eco said that anyone who started watching Hamlet after the beginning of the second act would not be able to understand why Hamlet was being so rude to his uncle (who had killed Hamlet’s father and married his mother in the first act). Why was Hamlet behaving in such an insulting manner towards his uncle, who was a nice and understanding old man as far as the second act showed? The moral of the story: It is necessary to consider what happened in the first act when assessing the second act. I keep telling myself “Do not forget the first act” when thinking on the exchange rate movements and the debates on the Kurdish issue that currently occupy the agenda. I advise the same to you.

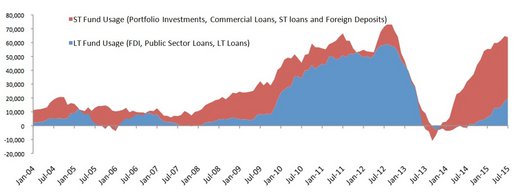

Now, taking a look at the exchange rate developments in the first act, the key to understanding the issue is the above statement by the CBT. The CBT has declared that exchange rate movements will contribute to the rebalancing of domestic and foreign demand. Even though it occasionally acts as if it is unhappy with the exchange rate adjustments, it seems that the Bank is actually happy with the turn of events. An imbalance exists between Turkey’s capacity to earn foreign exchange (FX) and the actual FX need of the economy. The crisis in Europe has been affecting Turkey’s capacity to generate FX via exports adversely. On the other hand, the buoyant domestic demand has pushed up the FX need of the economy. We call this imbalance the current account deficit. Before, the ratio of the current account deficit to FX generating transactions did not exceeded 30 percent under normal circumstances. The ratio now is above 40 percent. What is more, as the figure below also suggests, the deficit increasingly is financed by short-term foreign fund inflows.

The figure below outlines the first act. The economy accumulated risks during the process of uncontrolled growth. The exchange rate adjustment is seen as a remedy to this problem as an alternative to taking direct measures. Now we are witnessing an exchange rate adjustment process which will increase the cost of foreign fund inflows and facilitate FX generating transactions. What do you do if you want to drive a nail into a wall? You either hit the nail into the wall or move the wall into the nail. It appears that Turkey has chosen the second option over the first.

The CBT insists that "the exchange rate adjustment will establish the balance." To my understanding, it says that this is how the outlook of the economy will be sustained. On the other side, the CBT tries to strengthen the perception that the current account deficit will go down in the second half of the year. Meanwhile, things are getting even messier in Europe. It seems that Turkey is in a riskier position than it was in 2008 concerning deficit finance. So, where do you think the exchange rate will head?

Figure 1: Maturity Structure of Foreign Fund Inflows (million USD)

This commentary was published in Radikal daily on 23.09.2011