Things are the same at FED, we must focus on Europe

We should not expect a policy change that will trigger capital outflow from countries like Turkey until the end of 2012.

After the committee meeting the day before, the Federal Reserve (FED) made a release which maintained that while the economy had been expanding moderately, unemployment rate remained elevated. It drew attention to the risk that problems of the global financial system might reverse the moderate growth performance. Also, it highlighted that inflation had moderated.

Before the meeting scheduled in September, everyone was discussing whether the FED will initiate a quantitative easing. During 2010 and 2011, Turkey was able to finance current account deficit (meet the foreign exchange needs) easily thanks to abundant liquidity injections at low interest rates in developed countries, the US to begin with. This liquidity flew towards countries like Turkey which promised higher returns and which had prospects for growth. These inflows could have intensified. But after its meeting in September, the FED announced that they would not introduce a new quantitative easing. The remarks after yesterday’s meeting reveal that the FED will stick to this plan. In short, capital inflows will not be intensifying.

No policy chance expected during 2012

Should we expect a movement in the opposite direction? In other words, might the FED change the policy framework, triggering capital outflows off countries like Turkey? After the same meeting, FED officials declared that unless current circumstances change, the FED will warrant the current low-rate policy. Therefore, we should not expect a policy change that will trigger capital outflow from countries like Turkey. If so, economic developments in Turkey in 2012 will be influenced mainly by the developments in Europe.

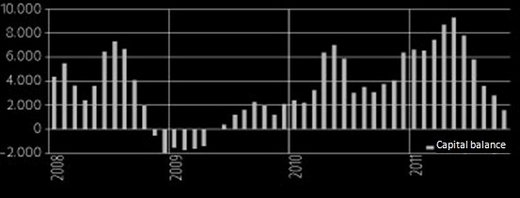

It becomes increasingly harder for Turkey to access foreign funds. Figure 1 shows net quarterly capital inflows since the beginning of 2008. Monthly net capital inflow on average decreased from US$ 7.8 billion in the first quarter to 3.2 billion in the third and 1.9 billion in the third quarter. Current developments in Europe escalate the risk of net capital outflows and of witnessing the same trend observed between the late 2008 and the second half of 2009. There are three reasons why to expect this: first, European banks are cutting the size of their balance sheets to close their capital gap, implying that volume of credit supply available for Turkey and peer countries will decrease. Second, risk perception might increase and thus capital might flow to a safe haven. Third, troubled countries have to make public sector borrowing extensively.

During 2010 and 2011, Turkey’s foreign liabilities were shorter-term. Short-term debts cause a heavy pressure of finance if not renewed by the lender. While the borrower country is trying to access new funds to repay the due debt, it causes exchange rate to escalate and balance sheets to shrink. This is the underlying reason for weak growth prospects and even economic contraction, should circumstances become harsher. Of course, there are steps Turkey can take to counteract these developments. I will try to talk about this in more detail soon.

Figure 1. Current account deficit finance (net capital inflow): January 2008–October 2011 (quarterly averages, US$ million)

This commentary was published in Radikal daily on 15.12.2011