Let’s hope for the best!

Since July, capital inflows have been standing below the amount required to finance the current account deficit concerning three-month cumulative figures.

Yesterday, balance of payments figures for January were announced. Today, I want to share with you some points that attracted my attention. First is that, the drop in the current account deficit, observed during November and December, ceased in January. Current account deficit maintained the level in January 2011. How you interpret this development, of course, depends on how you read this. From one angle, you can be content as the current account deficit did not increase compared to the year before.

Turkey unable to meet financing needs

What is even more striking is that when figures are taken as the cumulative for previous three months in order to eliminate monthly fluctuations, it appears that since July, capital inflows have been standing below the amount required to finance the current account deficit. This is bad news. FX expenditures are higher than FX generating transactions (that is, the economy has a current account deficit) which gives way to financing needs. Before July, this need was satisfied via short-term borrowing. It was a source of anxiety, which was okay as soon as it made possible meeting the financing needs.

Since July, however, the financing needs of the economy could not be met via “normal” methods. There are two other methods of finance left: first is spending out of the pocket, that is, relying on FX reserves. Second is financing the current account deficit via net errors and omissions. This outlook is not unique for three-month cumulative results; the same applies also for the previous two months.

Will this challenge prevail?

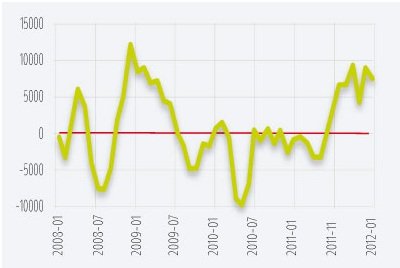

Graph 1 shows the difference between the finance needs for current account deficit and the amount accessed via “normal” methods (in million dollars). The difference being negative means that there were no finance needs during that particular period. Higher the difference above zero, severer the finance need. Please note that between the late 2008 and the early 2009, when the impacts of the global crisis were harshest, the difference was above zero.

I do not want to get you down, but it is extremely useful to state observations clearly. We are now going through a similar period. The financing problems for the second half of 2011 are evident. The question is whether or not these problems will prevail. We all know that the European Central Bank, which lent European banks generously on a three-year basis once in December and secondly in February, eased the liquidity problems of European financial system. The interesting part is that, Turkey witnessed financing problems also in January, after liquidity injections of December. Yes, we have to focus on the games ahead; but the score history of the last weeks is troublesome. So, let’s hope for the best!

Graph 1. Difference between the finance need stemming from the current account deficit and the amount accessed via normal methods, January 2008 – January 2011 (in million dollars).

This commentary was published in Radikal daily on 13.03.2012