Non-performing loans

The second set of measures announced this week was directed to credit cards. As per the new decision, debt of the credit cards which turned to be non-performing after May 31 2009 will be restructured if the owner of the card applies to the relevant bank within 60 days. As a result of the structuring, high penalty rate enforced as of the date the debt of the user becomes non-performing is deleted, interest rate for the debt is recalculated based on the deposit interest rate and the debt is subjected to an installment plan.

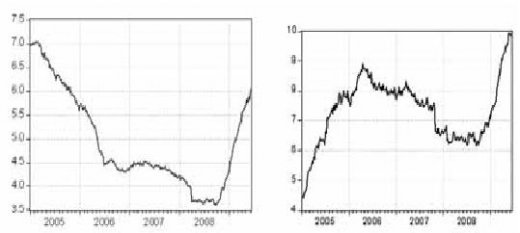

Another repercussion of the global crisis on Turkey was that the level of banks receivables that were not paid in time and became non-performing increased. Graph 1 shows the change in the ratio of non-performing loans to total receivable loans of the banks since January 2005. If the graph would have given the figures since 2001, we would have seen much higher values at the vertical axis. Thanks to the reforms in banking sector, strong supervision, regulation and the establishment of stability, this rate experienced a striking fall in time. However, there is an upward tendency since the second half of 2008. The rate reached 6 percent and it is yet not alerting; however it is wise to pay regard to the rise in the rate and the momentum of the rise.

This unfavorable phenomenon is highly valid for the credits extended to SMEs and consumers. As you can guess, the problem gets more prominent when the sub items of consumer loans are examined. Graph 2 shows the ratio of non-performing credit card loans to total credit card usage over the same period. And the upward tendency in the ratio as well as the current non-performing loan rate (10 percent) since the second half of 2008 is striking.

This phenomenon constitutes the main ground of the currently made decisions. The decision takes an important favorable step in particular for the credit card holders the bills of whom have expanded significantly due to default interest; the mentioned social dimension of the decision is of course important. However, you expect to see an impact beyond this.

And such impacts will not be at a large extent when the share of credit card loans in total loans and the ratio of non-performing credit card loans to total credit card usage are considered. Nonetheless, the decision will lead to a certain rise in consumption expenditures: It will directly lead to a fall in the level of accumulated debt and indirectly improve consumer confidence. On the other hand, it is also beneficial for banks; this way they will be able to collect their receivables more easily.

Naturally, however, the other side of the coin is different: Yes, credit cards are not a type of credit despite what the name implies. However, they are used as a type of credit by a considerable number of consumers. But the interest imposed on this 'credit' is much higher than other types of consumer loans. It is obvious that banks' practice to market credit cards even on the streets is among the main reasons of the problem constituting the grounds for the decision that was taken. However, what types of measures are considered to prevent that this unpleasant situation does not arise again is not explained. We hope that there will be no need to take such a decision in the future. Of course we are the hopers and the authorities are the measure-takers.

This commentary was published in Radikal daily on 21.06.2009