On inflation

If price of crude oil does not change, the future performance of inflation will depend on the exchange rate developments.

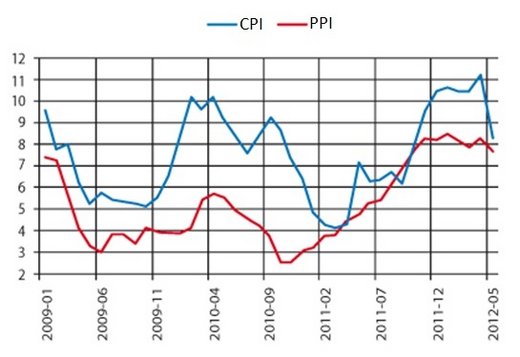

In recent commentaries, I assessed economic developments with a growth-based perspective. Today, I want to comment on inflation. Consumer price inflation that floated around 10 percent since December and reached 11 percent in April has dropped sharply in May. Though a drop was anticipated, the magnitude was beyond expectations. The headline inflation indicator that gives a better idea about the possible future changes in inflation also performed positively. The headline inflation calculated with the L indicator implies that the upwards trend in inflation that started in the late 2010 has ended (Figure 1).

Up until a couple of weeks ago, many were concerned about the course of inflation. The Central Bank’s (CBT) forecast was 6.5 percent, above the official target at 5 percent. On the other hand, many argued that year-end CPI will be around 8 percent or above. Recently, however, we are hearing more optimistic accounts. Reports by financial institutions maintain that the CBT’s forecasts now seem realistic.

Moreover, I expect that the CBT will lower its year-end inflation forecast in the light of the latest data. My expectation is based on three factors. First and foremost is the fall in crude oil price. In the second inflation report of 2012 released in late April, the CBT had changed its assumption on oil prices on the basis of the data then available. It was an upwards adjustment: assumption for the barrel price of Brent oil was increased from $110 to $120. The barrel price floated around $119 during late April. After that date however, it dropped significantly to $93, indicating a drop by $22. This will make a major positive contribution to inflation outlook.

Second, as I discussed during recent commentaries, the economy slowed down significantly in the first quarter and there are signs for a similar outlook in the second. Even if there is an upwards trend in growth, it has started earliest in May with the most optimistic perspective. More importantly, this trend is probably a weak one. Under these circumstances, there will be no upwards pressure on inflation driven by domestic demand. The CBT has been arguing this for long, but it was rather for the first quarter. The outlook in the second quarter also will contribute positively to the anti-inflationary efforts.

Therefore, if crude oil price does not change, the future performance of inflation will depend on the exchange rate developments. As the rise in risk appetite will put a downwards pressure on exchange rate, inflation will move harmoniously with the CBT’s (new) forecasts. But if risk appetite weakens and exchange rate tends up again, the former forecasts of analysts at 8 percent will be the realistic one.

Figure 1. Consumer price inflation and headline inflation (L indicator): January 2009– May 2012 (annual, %). Source: TURKSTAT.

This commentary was published in Radikal daily on 23.06.2012