Repercussions of the crisis

September 2008, with the bankruptcy of Lehman Brothers, is accepted as the date of the emergence of the crisis. Today, I would like to analyze the development of the crisis in Turkey starting from a bit earlier than that date. Here, I will examine the figures for almost one and a half year.

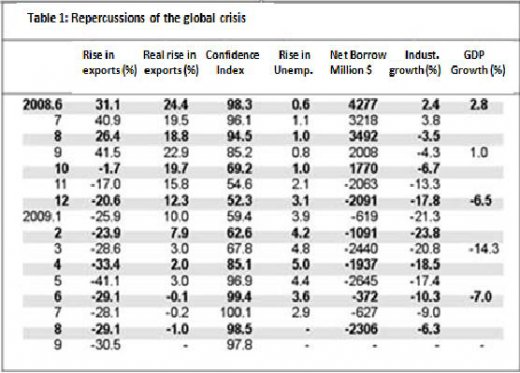

I have always been emphasizing that the crisis affected Turkey through four channels: fall in exports, banks' and firms' turning to net foreign debt payers, fall in volume of domestic credits and the fall in the confidence in the economy. Table 1 shows the percentage rise in exports in dollar terms in the first column and in total volume of credits extended by Turkish banks in the second column in comparison with the year before and net of inflation. Figures in the third column represent Central Bank real sector confidence index. Figures above 100 imply that confidence increases and figures below 100 imply that confidence decreases. Net foreign borrowing of firms and banks are given in the fifth column. Figures below zero indicate that value of newly found funds is below the amount of due debt repaid.

The variables ultimately affected by the changes in these figures are production and employment indicators. Rise in general unemployment rate compared to the year before is shown in column four. Sixth column presents the rise in production as calculated by industrial production index while the last column shows the GDP growth, both in comparison with the same period the year before.

Since I am reviewing the crisis, I can repeat some certain points: First, the crisis has affected Turkey not slightly but quite deeply. Second, figures for production and unemployment appear to get slightly better. However, as I emphasized for several times, we make this conclusion in comparison with the year before, figures for which is also worse than two years before. Third, net fund transfers to abroad do not even lose pace since August. Though the same appears to be valid also for exports, data for the first twenty days of October imply that exports increased by 10 percent compared to the same period last year.

Weekly credit figures showed that volume of credits not net from inflation achieved the pre-crisis level. Fourth, using monthly crisis data and more importantly when the impact of the inflation is removed, however, it is observed that credits tightened compared to the year before. Fifth, we have to say that the confidence in the economy has eroded even slightly in the last couple of months.

Should responses in the same direction had been immediately given to the crisis without any shame (at a sufficient level), these figures would have been expected to be less adverse. Of course this is hard to prove, but it is still beyond intuition because as I said before, a significant proportion of the recent recovery in unemployment and industrial production would have been realized even if we did not take any step at all.

This commentary was published in Radikal daily on 25.10.2009