Confidence in the economy: increasing or declining?

Without confidence in the economy, people defer their investment decisions and wait for the fog to disperse even if there is access to loans and interest rate is at a reasonable level.

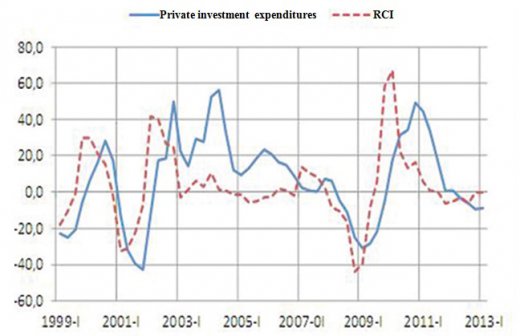

Reel sector confidence index and real private sector investment expenditures: 1999 Q1 - 2013 Q1 (annual % changes)

Today two important statistics will be released: real sector confidence index and capacity utilization ratio for July. Real sector confidence index in particular is of specific importance this month.

Since the second quarter of 2012, private sector investments have demonstrated year-on-year declines. These were quite sharp in the last quarter of 2012 and the first three quarters of 2013. On the other hand, GDP growth rate was 3 percent in the first quarter mainly because of the rises in private sector investment and consumption expenditures. Yet it is impossible to sustain high growth rates by stably increasing public sector expenditures. Private sector has to step up at some point. The share of private sector investment expenditures in GDP is around 20 percent. But due to its fluctuant structure, it has always been one of the chief determinants of growth performance. Since GDP figures GSYH are announced with a delay, we do not know yet how private sector investments have evolved since April.

Fortunately, real sector confidence index lights the way for us. It is up-to-date and gives instantaneous information on the outlook. Besides, it gives hints about how private sector investment expenditures will develop later that year. Without confidence in the economy, people defer their investment decisions and wait for the fog to disperse even if there is easy access to loans and interest rate is at a reasonable level. Figure 1 above successfully demonstrates that the fluctuations in the confidence index precede those in private sector investment expenditures. That’s why confidence index is sometimes a more important indicator than the level of interest rate or the backward-looking credit growth rate.

2012 was an unpleasant year concerning the confidence in the economy as compared to 2011. Excluding December, real sector confidence index figures were in tandem with private sector investment expenditures, both showing a downward-trend. The figures increased moderately in the following three months and decreased slightly between March and April. Then, in June was observed strong growth.

The indicators that we do not pay much attention when the economy runs “under normal conditions” become of vital importance in abnormal periods. It is not possible to say that the “normal conditions” rule nowadays. Therefore, it is a key concern how recent developments in Turkey as well as the turmoil in international financial markets over the last two months and more have affected the real sector’s confidence in the economy. The index value for July will show us whether or not confidence has eroded. Let’s wait and see.

This commentary was published in Radikal daily on 25.07.2013