The BRSA’s decisions: Both timely and not (2)

So, the billion-dollar question is, why did the BRSA not step up earlier in the late 2010 or early 2011?

The Banking Regulation and Supervision Agency (BRSA) has attempted critical decisions. The draft documents were released on the Agency’s webpage for public discussion. High credit growth rate is a threat to financial stability. It pushes up consumption and investment and hence the current account deficit. If the level and the growth of investment are already weak, consumption comes to the radar for intervention.

This is the case in Turkey currently. Investment to GDP ratio is around two thirds of that in developing countries. Moreover, investments have declined year-on-year since the early 2012. Consumption is the culprit. Don’t get me wrong; there was no “boom” in consumption over the mentioned timeframe. Indeed, private consumption expenditures declined year-on-year in 2012. It began to recover starting in 2013 with 3.6 percent and 5.6 percent growth in the first and second quarters, respectively. But the problem is not the consumption but the weak GDP growth. The share of consumption has been high and that of savings has been in decline since 2002. Differently this year consumption grew more rapidly than GDP.

As a result, domestic savings to GDP ratio has fallen to intolerable levels. The Medium Term Program estimate for 2013 was 12.6 percent compared to the developing world average at 32.8 percent. This is a drastic gap. Under the same level of investment, low savings rate implies high current account deficit. To finance the deficit, you have to borrow from abroad. Foreign fund flows will diminish when the Federal Reserve initiates tapering. Turkey is one of the five countries that will be affected most severely and is cited in the top two in some sources.

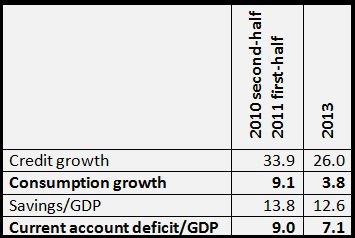

Due to these, Turkey wants to reduce the credit growth rate by lowering the consumer loan growth. There is not much that the Central Bank (CB) can do. Using the interest rate policy to lower credit growth is not reasonable and is debatable if it would be useful. The CB used another instrument starting in the late 2010: it raised the reserve requirements. As I wrote tens of times back then, this step had no chance of success and hence it failed. It is the BRSA which has the tools that can actually lower credit growth. From this perspective, it is the right call for the BRSA to step up. But the timing is quite bad. To draw a clearer picture, I am giving a comparative table below: first period covers between the second half of 2010 and the first half of 2011, and the second covers 2013. Figures for the latter are from the Medium Term Program except credit figures.

So, the billion-dollar question is, if the objective was to lower credit growth rate, why did the BRSA not step up earlier in the late 2010 or early 2011, when consumption, current account deficit and credit growth rate were much higher? In fact, it the BRSA had taken action back then, it would most probably not need to take any action today. Hence, the BRSA’s decisions were correct but untimely.

This commentary was published in Radikal daily on 30.11.2013