What Can Turkey's Sovereign Wealth Fund Do With This Portfolio ? Evaluation Note / Emin Dedeoğlu

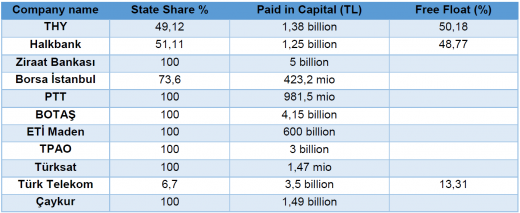

The Turkish Sovereign Wealth Fund (TWF) has recently been in the subject of public discussion since its establishment in August 2016. The National Lottery, games of chance and horse racing were placed in the Fund since. On February 5th, the subject came up again when some public lands as well as public securities listed in the following table were added to the fund. The public shares in Turkish Airlines and Halk Bank, previously under the Privatization Administration, are the most notable additions.

In addition to these assets, TRY 3 billion in cash from the Defense Industry Fund was transferred to the TWF to be paid back in 3 months.

With such recent transfers, the total amount of assets in the TWF has grown significantly, spurring another round of discussions since the launch of the TWF. Many critics assert that the Fund is not transparent and exempt from the audit by the Court of Accounts. Besides, some state that, unlike the wealth fund practices in much of the world, the TWF is mainly established to provide funding for major infrastructure investments. Turkey after all, does not have abundant natural resources and balance of payments or budget surpluses. Critics, rightly underline that if the objective of the TWF is to finance the infrastructure investments, for all practical purposes, it will be no different than the past, “Public Participation Fund” implementation and so it will compromise the principle of "Unity of Treasury". As it is known, established as an off-budget fund, the Public Participation Fund financed highways and bridges, mainly by issuing Revenue Sharing Certificates (RSC’s), against the future revenues to be obtained from such investments. However, the fund practically served to circumvent fiscal discipline, issued high amounts of RSC’s, which was deeply discounted in the secondary market and eventually ended up in the Treasury’s books. Later the Fund was abolished after being transferred to the Treasury, and the outstanding RSC’s have been redeemed using tax money.

You may read full paper from here.

- What Can Turkey s Sovereign Wealth Fund Do With This Portfolio

Related Publications

- Emin Dedeoğlu

- Emin Dedeoğlu