What comes with FED goes with FED

'FED's balance sheet will not remain at this size. Neither will the interest rates.'

One distinguishing feature of the year 2010 when Turkey is concerned is that foreign exchange (capital) inflows are mainly short-term. In the first nine months of the year the amount repaid by the corporate sector was US$5.5 billion higher than the amount of the long-term credit borrowed. This difference for the banking sector was US$0.4 billion. Foreign direct investments, frequently declared to be the most desired sort of capital inflows, dropped significantly to only US$4 billion. I would like to stress the 'only' part because this amount is significantly low compared to the 2006-2009 period.

On the other hand, short-term debt used is quite high: US$5 billion by banks and US$0.9 by the corporate sector. Moreover, short term capital amounting US$13 billion has flowed in Turkey through portfolio investments.

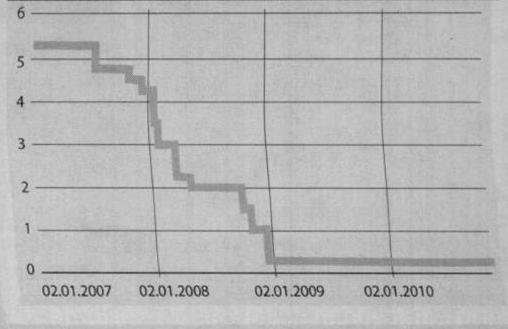

I how this is too much of numbers for a Sunday; let me also provide a figure. It is not about Turkey; we are having a short trip to the USA. The figure depicts the short term interest rate policy of the FED since 2007. There appears a steep fall over a short time period and the rate currently stands at 0.25 percent.

Shoot! I have to talk about numbers again. So I go back to the USA and take a look at FED's actions. The major interest rate cut by FED is introduced at the end of June 2007. In July 2007, balance sheet of FED was US$874 billion. This rose to US$2.3 trillion by the end of 2008. This implies a significant monetary expansion (Note: US$1 trillion of this monetary expansion resulted from the transfer of mortgage loans in balance sheets of financial institutions to FED.)

A significant proportion of this liquidity was created to end the fire in the US financial system and than to make the financial institutions able to extend loans again. However the credit channel in the US still does not function properly. For instance as of the end of 2010 quarter two, mortgage housing loan level is lower than that in 2009. And the level in 2009 was lower than that in 2008.

Such low interest rates and high liquidity coupled with the problems facing the EU and the USA turn into severe troubles for countries like Turkey. I believe the data on Turkey I mentioned at the beginning is not coincidence. But the problem is that FED's balance sheet will not remain at this size. Neither will the interest rates.

What was the saying: 'What comes with FED goes with FED'.

Figure: FED's policy rate since 2007 (%)

This commentary was published in Radikal daily on 28.11.2010