Growth performance is pleasing, but then what?

Then, locomotive of growth can only be domestic demand.

On Friday we heard the growth figures for the third quarter of the year. Both the industrial production figures and data related to GDP as announced before Friday implied that growth was above expectations. But the growth figure for the third quarter remained below the expectations for the first time: 5.5 percent.

Although growth rate stood below expectations it was validated that Turkey overcame the crisis with respect to production performance: In the second quarter of the year GDP (net of seasonal and calendar effect) reached the pre-crisis peak level in the first quarter of 2008. With the performance in the third quarter this peak was surpassed; there is a 1.4 percent difference between the level in the third quarter of 2010 and the pre-crisis peak level. Yes, this is not a substantial difference but it is not at all negligible either.

Contribution of private investments

When source of growth in the third quarter is examined we see that private investments made a significant and apparent contribution. Private consumption expenditures also made a similar strong contribution. On the other hand export of goods and services made a negative effect on the pace of growth.

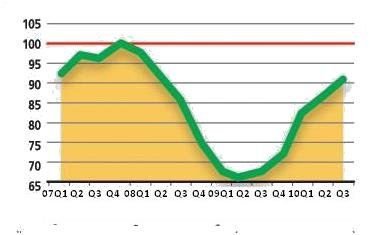

Despite its significant contribution to growth private sector investments could not regain the pre-crisis level yet and in fact stands 9 percent below the pre-crisis peak level. The figure below shows the movements in private sector investments since 2007. There appears a lucid recovery; but it is also apparent that we are still in the pit. On the other hand the positive movement in investments was not something unexpected. First domestic demand will recover and producers will start working in full capacity and then they will initiate a feverish investment activity.

I along with some commentators expected a slowdown in the pace of growth in the second half of the year. But although growth stood below expectations it is not possible that our estimates proved correct. Industrial production for instance showed a rapid rise in October.

But then what? Can the dynamic growth performance be sustained? Export performance will be a determinant among others. I previously said that export performance have worked against growth in the third quarter. Data by Turkish Exporters Association indicates that the rise in exports has slowed down in October and November. The conditions facing the EU, which receives almost 50 percent of Turkey's exports, is not a big secret. And further deterioration in such 'conditions' is quite likely. On the other hand it is understood that developing countries and particularly the USA will go on with the very low interest rate and monetary expansion policy. Under these circumstances intensification of the appreciation pressure on Turkish lira can be expected unless a large crisis erupts across the EU.

It is evident that the mentioned factors are unfavorable for Turkey's exports and thus pace of growth. In that case, the locomotive can only be domestic demand. I will make a more detailed analysis later. For now let me underline that in 2011 growth rate around the average growth rate of the last six decades (4.7 percent) can be achieved.

Figure: Private Sector Investments: 2007 Q1 - 2010 Q3 (index: 2007Q1=100)

This commentary was published in Radikal daily on 12.12.2010