Taking advantage of the 2001 crisis

The biggest mistake made was the failure to advance upon the banking sector the major weaknesses of which became to be understood much later.

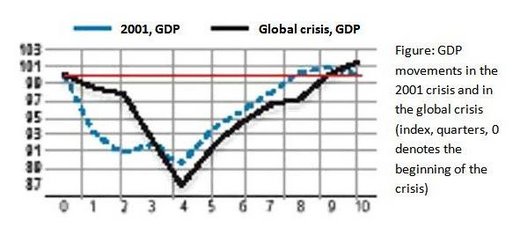

Which crisis was deeper? The 2001 crisis or the 2008-2009 crisis? To answer this question, assessing two indicators will be sufficient: the change in unemployment rate and in gross domestic product (GDP).

The definition of the data on the labor market changes frequently preventing a healthy comparison. So it is more solid to compare the changes in unemployment rate rather than the rate itself. Unemployment rate increased from 6.5 percent in 2000 to 10.3 percent in 2002 and to 10.5 percent in 2003: average increase in three years compared to 2000 is 3.25 points. Unemployment rate stood at 10.3 percent in 2007, reached to 14 percent in 2009 and is estimated to stand at 12 percent as of the end of 2010. In the 2008-2010 period unemployment rate increased in average by 2.03 points compared to 2007. In this context, the performance was slightly better in the global crisis.

The figure below gives the movements in GDP net of seasonal and calendar effects after the pre-crisis peak level denoted with 100 (quarter zero). GDP comparison reveals a result in favor of the 2001 crisis. The economy contracted more significantly in the global crisis. But is this comparison fair? The global crisis did not originate in Turkey. However the 2001 crisis was completely Turkey's fault. Another question posed against the former: to what extent is it fair to put the blame of the 2001 crisis on the ruling government back than? My response is clear-cut: If you consider solely the depth of the impact of the crisis, the comparison on the basis of GDP and unemployment rates is quite fair and objective. Nevertheless, it is not fair to put the blame of the 2001 crisis solely on the government in power then. Crisis is an outcome of a process; a final product of the wrong economic policies implemented over years. Let me present a table to reflect the circumstances in the period before 2001. The table gives the macroeconomic indicators for the 1996-2000 period. The GDP figures in the table are those that were valid back under the calculation method back then (as per the new calculation method GDP level for each year is approximately 33 percent higher).

If I am not wrong, in the 1996-2000 period the political views - or let us say the close relatives of the political views - represented in the parliament today were entirely in power for some time. The economy was quite weak in the period before 2000. Budget deficit, inflation rate and borrowing interest rate were quite high. Public banks were made to shoulder high levels of duty losses (budget transfers not recorded in the budget and disguised in the balance sheets of public banks). GDP growth was instable. In the early 2000, the political power did not other ruling parties had done before and put into effect a stability program to overhaul the weak economic performance. As you can see below, many of the indicators improve in 2000. I would like to draw your attention particularly to the fall in the inflation rate and in the public borrowing requirement. The biggest mistake made was the failure to advance upon the banking sector the major weaknesses of which became to be understood much later. This was why the 2001 crisis emerged. But have a heath! Did the banking system collapse in just a year? Taking a look at the duty losses of the public banks alone is enough to answer this question. Anyway, that is all for now. I will continue with this topic.

|

TABLE: MACROECONOMIC INDICATORS BEFORE THE 2001 CRISIS* % Ratio to GDP |

||||

|

|

1996-97 |

1998 |

1999 |

2000 |

|

Public sector borrowing requirement Duty losses of public banks Primary surplus Consolidated budget deficit Consolidated budget interest payments Public debt Average Treasury auction rate (%) Year-end consumer price index (%) GDP growth rate (%) Current account deficit / GDP |

8.3 4.8 1.0 8.1 9.0 43.5 129.4 89.5 7.3 1.4 |

9.6 7.7 2.2 7.3 11.8 41.4 115.5 69.7 3.1 -1.0 |

15.8 13.4 -1.9 11.7 13.9 52.6 105.6 68.8 -4.7 0.7 |

12.6 12.1 3.8 10.3 16.4 54.4 36.2 39.0 7.4 4.9 |

This commentary was published in Radikal daily on 24.02.2011