Will the credit expansion continue?

I have previously shared my growth estimates for 2010. If the assumptions in my basis scenario hold, growth rate in 2010 was expected to be between 3.8 percent and 4.9 percent. The indicators announced in the last couple of years stated that growth rate can even go above the upper limit of this interval: data reveal real credit expansion, exports tend increasing and the confidence in the economy has been recovering substantially.

However, risks started to grow since the growth rate stood below the optimistic estimates commonly stated. The mentioned risks are closely associated with the recent developments in the EU. The crisis in the EU might deepen further. Even if it does not, there still exists a risk with respect to Turkey's growth rate: the risk that the EU economies cannot recover and thus their exports do not increase as much as expected. Approximately 50% of Turkey's export volume is delivered to the EU countries. Such a slow recovery scenario clearly affects Turkey negatively.

If the crisis deepens, we cannot foresee when it will stop. Banks might cease extending credits, the real sector might have to transfer higher amounts of capital to abroad. In such a milieu, the corporate sector might cease investments and consumers might cut down spending on durable goods in particular. We are quite familiar with this picture from what we have gone through in the late 2008 and the first half of 2009.

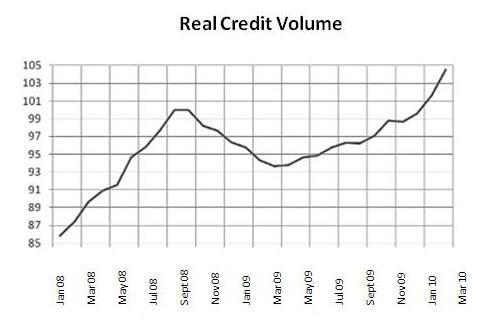

Today I want to examine the movements in domestic credit volume. As I stated in the first paragraph above, the developments in this field are favorable (for now). Real credit volume reached the peak level before the crisis in September 2008. This peak was exceeded as of March 2010 (Figure 1). The figure also shows the drop in the real credit volume as of the eruption of the global crisis following September 2008. The deepening of the crisis in the EU might also cause a similar trend in the credit market.

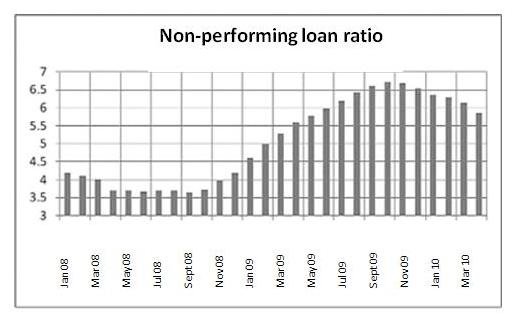

Another phenomenon faced along with the global crisis was the increase in the ratio of non-performing loans. The change in this ratio is given in Figure 2. For instance, the ratio increased from only 3.7 percent in September 2008 to 6.7 percent in October 2009. One major element that prevents a further hike in the ratio was the successful regulation that allowed the restructuring of non-performing loans. This way the corporate sector was able to breathe again. However it is important to stress one point: if the legislation applicable when the non-performing loan ratio was 3.7 percent had not been amended, the current ratio would have been much higher.

On the other hand, we must also note that following the 2001 crisis the mentioned ratio reached 26 percent as of August 2002. It is primarily the Transition to the Strong Economy Program implemented after the 2001 crisis that maintained the non-performing loan ratio way below that witnessed in the aftermaths of the 2001 crisis. One of the biggest contributions of the said program was the favorable structural changes introduced in the banking sector. However I would like to stress once again that the ratio elevates if the crisis in the EU deepens.

Figure 1: Movements in the credits the banking sector extends to the non-financial sector, net of inflation (Index: September 2008=100, 2008 January - 2009 April)

Figure 2: The ratio of non-performing loans in total credits extended by the banking sector (%,2008 January - 2009 April)

This commentary was published in Radikal daily on 23.05.2010