Investments recover reluctantly

We all know that investments contract significantly in crisis periods. Consumption decreases less then investments do. The reason is obvious: a large proportion of consumption expenditures constitute of basic expenditures. These are impossible to forego; so a shift to lower-quality products are observed. During the recovery from crises, the movements in investment expenditures generally do not match with the pace of recovery. The main reason might be the desire of investors to make sure that the recovery will be permanent.

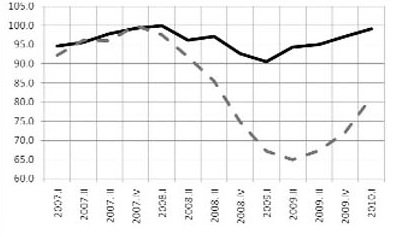

The movements of investment and consumption expenditures in Turkey during the latest crisis were also in this parallel. Figure 1 shows the changes in private consumption (black line) and private investment expenditures (dashed line) since the beginning of 2007. Both of the series are seasonally adjusted. Moreover, series are adjusted in which the peak levels before the crisis are denoted with 100.

Figure 1: Private consumption (black line) and private investment expenditures (dashed line), seasonally adjusted - 2007 Quarter 1 - 2010 Quarter 1 (index)

Two points to stress: first, the trough of investment expenditures is incomparably low. Second, although both series are observed to recover, private investments still remain very low. Even though this is in line with the general observation I stated at the beginning of the summer, the outlook requires special attention.

We are faced with a decade-low interest rate. Interest on consumer loans stand at 11 percent. Sound firms can receive loans at reasonably low interest rates. Real interest rates (adjusted to the inflation) are unprecedentedly low considering inflation realizations and expectations.

The volume of loans extended by banks demonstrates a significant surge in terms of not only nominal credit volume but also the volume adjusted to price movements. Taking into account the average volume in June, there appear a 14.5 increase in the volume of total loans and a 10.1 percent increase in the volume of consumer loans since January in real terms.

On the other hand, the recovery in private sector investments is laggard. The initial results of a study conducted at TEPAV imply that large firms are in a "wait and see" mood. But we need to emphasize that the latest data in the mentioned study and the above figure belongs to the first quarter of 2010.

We have to more recent indicators at hand: first is the volume of investment goods imports for May. It indicates that seasonally adjusted vehicle and non-vehicle imports stand significantly below the pre-crisis peak. Here significantly refers to a gap of more than 20 percent. The second indicator is the real sector confidence index announced by the Central Bank of Turkey. As you might remember, the index decreased in May and June. The figure for July will be announced this week. Given the signs of a slowdown in the pace of recovery in developed economies and the series of elections ahead Turkey imply that the contribution of private sector investments to economic growth will be weak.

This commentary was published in Radikal daily on 26.07.2011