Do you need to see evaporation to be convinced?

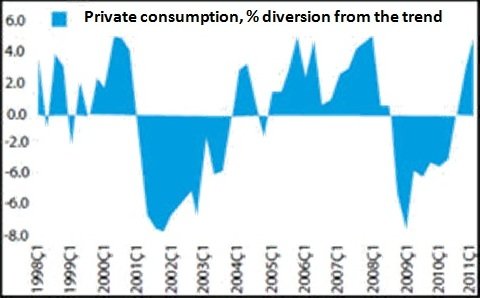

In the last two quarters, and in the last quarter in particular, private consumption expenditures stand clearly above the trend line.

Topics are coming over me. Of course I cannot complain. Who would like to beat their brain to decide what to write in these summer days? But I was actually willing to continue from where I stopped on Tuesday. In fact, I promised to do so. However, I am sorry to say that cannot keep that promise.

The reason is the ongoing debates: It is heated, it is not heated. It is heated but not that much... Please let go whatever it is that we are measuring the temperature of - the economy, more specifically. If you shift the focus towards as to whether this brings a problem or not, I promise I will participate and provide evidence that the weather is indeed quite "hot".

What would you do if you were given some data on a country you are not familiar with and asked you to comment on the potential risks facing it? Thank God, I was not asked to do this before. If I was asked, I would first check if the real interest rate was high. If it was high, I would try to investigate the reason. I would check if the budget deficit and the public debt stock were high. If the answer was no, I would take a look at the banking sector data to identify the risks: open position, non-performing loans, and short-term debts. I would not relieve even if I found out that these were non-existent and I would then examine the current account deficit. Is it high? If it is, how is it financed? With short term borrowing or long term borrowing? These would be the key items I investigate, maybe in a different order.

So, is Turkey's current account deficit substantially high? Yes it is. Is this deficit financed via long term borrowing? Unfortunately not; it is financed predominantly by short term borrowing. Leave aside the heating up issue; is this not a major problem alone? For me, the answer is yes, especially considering the current global circumstances. The world is now discussing whether Italy will go bankrupt or not. What else do we need to hear? And the heating up debates. If I were in their shoes, I would focus on the private consumption expenditures instead of gross domestic product (GDP) figures. In the extreme case, the GDP can be generated entirely by exports. And in the other extreme, you might have no exports and make domestic consumption alone. Which extreme is more significant if the heating up debate concentrates on inflation? There is no need to talk more, the answer is evident: the latter is more significant considering inflation.

The figure below shows the diversion of seasonally adjusted private consumption expenditures (70% of the GDP) from the long-term trend. In the last two quarters, and in the last quarter in particular, private consumption expenditures stand clearly above the trend line. There is a close relationship between this outlook and the high current account deficit phenomenon. You can calculate the trend in several ways. But, judging from the huge difference between the current level of consumption and the long-term trend, what does calculating the trend with another method bring to the table? This is nothing but heating up. Do you need to see evaporation to be convinced that the economy has heated up?

God forbid!

Figure 1. Private consumption expenditures, % diversion from the trend: 1998Q1 - 2011Q2 (higher the diversion in the positive zone, more "extreme" is the consumption, indicating the heating up of the economy)

This commentary was published in Radikal daily on 14.07.2011