Turkey’s sovereign rating increased relatively

The impact of the global crisis was more limited on developing countries than rich countries at the core. However, the sovereign rating of developing counties is still below that of developed countries in debt crisis. Causes of this was addressed in a policy note titled "Sovereign rating cannot be upgraded without structural reforms" published on TEPAV website in January 2011[1]. The mentioned study associated the stand-still in Turkey's sovereign rating with the negative outlook of the current account deficit and budget deficit that has the potential to affect fiscal performance through various channels, and of the real exchange rate and growth volatility. In parallel with our expectations, Turkey's sovereign rating hasn't increased after January 2011 in absolute terms, though it has improved in relative terms. The reason for this relative improvement was the downgrading of ratings of Eurozone (EZ) countries.

The latest change in Turkey's rating by Standard and Poors (S&P) was an upgrading from BB/stable to BB+/positive on 19 February, 2010. Since then, the world economies have been changing radically. Not only the global crisis intensified but also it was realized thatdeveloped countries will not recover as rapidly as expected. A political dimension was also added to the picture with the failure of the US and the EU administrators in managing the crisis. Despite the unfavorable economic climate across the world, Turkey made it among the most rapidly growing economies. Meanwhile, however, current account deficit reached record-high levels. Credit rating agencies (CRA) taking these factors among others into account decided not to change Turkey's sovereign rating.

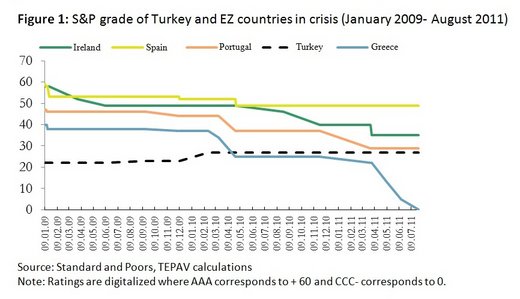

Turkey's rating assumed a vertical course while the ratings of the EZ countries moved downwards (Figure1). The negative revisions on Ireland and Portugal's ratings brought these countries closer to Turkey. Portugal was downgraded to "lowest investment grade" BBB-, just one level above Turkey's rating. Spain, the rating of which was downgraded four times since January 2009, is still AA, significantly above that of Turkey. Greece's rating was downgraded below that of Turkey with the revision introduced in April 2010 and was further downgraded to the lowest level that corresponds to junk status in July 2011.

Three conclusions can be drawn from Figure 1. To begin with, the consecutive reductions in the sovereign ratings of EZ countries in crisis actually indicate short-term uncertainties facing theses economies. The second one is related to the stability of Turkey's rating. The horizontal course of Turkey's credit rating implies that Turkey's economy poses less uncertainty in the short-term compared to the EZ countries in crisis. Finally, Turkey's rating is below all countries except Greece due to the fact that the structural problems of the economy still remain intact.

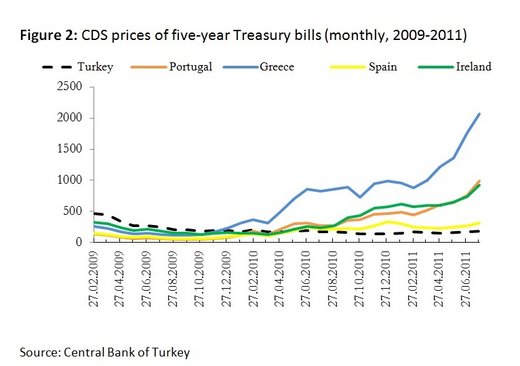

Sovereign ratings fail to present the impact of market volatilities on the risk perception against a country. The daily prices of Credit Default Swap (CDS) contracts that serve as a guarantee for delinquency, in a ways serves the function of sovereign ratings in periods when daily price movements accelerate. In that case, one might think that CRA's are replaced with market participants. The comparison of the CDS prices presented by Figure 2 below reveals that since June 2011, Turkey has been a less risky country than the EZ countries in crisis. In the light of this, we can conclude that the foreign fund pool that Turkey can access has grown considerably since the funds which under normal circumstances would prefer the EZ countries in crisis now would head towards countries suffering from fewer short-term risks.

To sum up, Turkey's sovereign rating increased relatively due to the reductions of the ratings of EZ countries in crisis. Moreover, as the comparison of CDS prices also suggests, the risk of delinquency for Turkey decreased considerably both in absolute terms and relative to the EZ countries in crisis. As a result of these, the amount of foreign fund inflows towards Turkey increased. The consequent expansion in the credit volume led to rapid increases in domestic consumption and investment. The mentioned increase in consumption and investment expenditures pushed up the estimations for the current account deficit as a ratio to the GDP to a historic 8 percent. Moreover, the weight of short term funds in deficit finance elevated[2]. Foreign funds escaping from uncertainty headed towards Turkey, which demonstrates a relatively more stable outlook, while they continued cautiously avoiding long-term contracts.

Due to the uncertainties arising as a result of the global crisis, fund managers tend to focus on short-term rather than long-term factors when making investment decisions. The relative improvement in and the stable outlook of Turkey's sovereign rating in such a climate appears to be the main factor driving the rise in foreign fund inflows. Nevertheless, this trend stemmed from the global crisis and it is still a huge question to what extent this favorable trend is sustainable. In order for Turkey to ease its vulnerabilities driven by the high current account deficit, the share of long-term fund inflows including foreign direct investments in overall sources finance needs to be improved. The way to achieve this is to solve the country's structural problems.

Limited progress can be made relying on the relative improvements in the sovereign rating. The fundamental objective should be to initiate structural reforms that will increase Turkey's sovereign rating in absolute terms.

[1] The mentioned study can be downloaded at: http://www.tepav.org.tr/upload/files/1296118294-5.Sovereign_Rating_Cannot_be_Upgraded_Without_Structural_Reforms.pdf

[2] 94 percent of the fund inflows towards Turkey in 2010 were short term funds. Please see the below note for detail information: http://www.tepav.org.tr/upload/files/1298620650-7.Current_Account_Deficit_Dynamics.pdf

Ozan Acar, TEPAV Economic Policy Analyst, http://www.tepav.org.tr/en/ekibimiz/s/1212/Ozan+Acar