Two points about balance of payments

The development in August might turn into a trend as long as Merkel and Sarkozy manage to “skillfully” continue to swing the lead.

I have not been talking about balance of payments figures for some time. But the captions and interpretations I saw on economics news channels after figures for August were announced on Tuesday attracted my attention. They were arguing that current account deficit decreased remarkably in August. Current account deficit decreased from $5.3 billion in July to $ 3.9 billion in August, indicating a 25% drop. But important sub-items of the current accounts such as exports, imports and tourism revenues fluctuate considerably due to seasonal effects. For instance, tourism revenues increase in summers and decrease in winters. Therefore, figures on current accounts like many macroeconomic indicators must be assessed on the basis of seasonally adjusted data. Seasonally adjusted figures do not reflect a considerable improvement in the current account balance in August. In fact, current account deficit has increased slightly month-on-month.

A considerable improvement

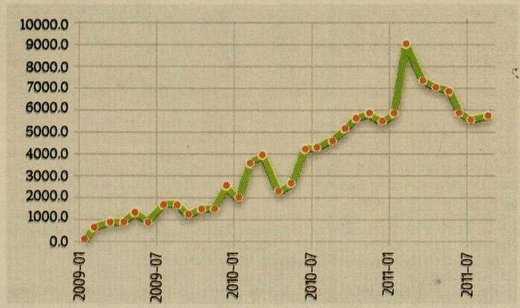

There is no doubt that the monthly changes in the deficit is not of critical importance. What matters is whether the indicator has demonstrated any trend in the last couple of months. If you revisit the figures for the previous months, you see that seasonally adjusted current account balance has been enhancing considerably since February. Unlike what news channels suggest, current account deficit has been demonstrating a downwards trend since February despite the slight increase seen in August (Figure 1). This is not really different than the point we were at in the second half of 2010 when we were complaining about the worsening of current account deficit. But still this is a positive development. The second striking thing about the current account balance figures for August is that the foreign exchange requirement caused by current account deficit was not financed via net capital inflows for the first time over a long period. In the first seven months of the year, net external finance amounted $50.4 billion, corresponding to $7.2 billion per month. In August, net external finance amounted only $0.8 billion.

Beyond observation

Does the “you cannot reach assertive conclusions on the basis of a one-month observation” warning apply here? It does not. There is more than an observation, just as in the case that the recent tendency of the current account deficit demonstrated an improvement despite the slight deterioration in August. This point goes beyond an observation, when expectations are also added to the picture: international markets were dragged into chaos once again by the end of July. As you will remember, the world faced a similar environment by the end of 2008 with the intensification of the global crisis. The development in August might turn into a trend as long as Merkel and Sarkozy manage to “skillfully” continue to swing the lead. This is what we are afraid of in the first place and this is what lies at the core of the latest exchange rate movements.

Figure 1: current account balance, seasonally adjusted, January 2009 – August 2011 (positive values denote deficit, billion $)

This commentary was published in Radikal daily on 13.10.2011