As pessimism is rebounding...

Between mid-January and March 21, the Central Bank of Turkey kept the short term interest rate at 7.5 percent. The rate currently reached 10 percent.

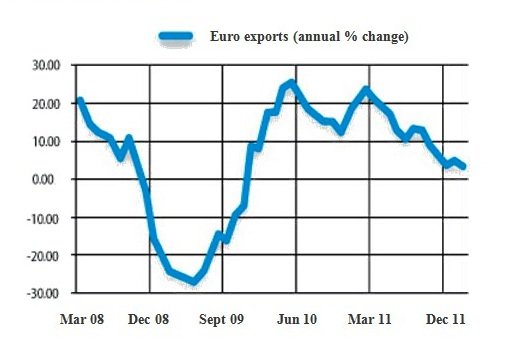

Foreign trade figures for February were announced. Turkey’s exports are half in Euros and half in Dollars. These two accounts did not demonstrate a significant shift in trend in the recent months. Three-month cumulative results showed that the pace of year-on-year increase in exports in Euros had been decreasing since February 2011. This trend prevailed also in February 2012 (Graph 1). On the other hand, exports in Dollars have been increasing year-on-year by a firm 20 percent for the last six months.

These inconsistent trends validate once again that the exchange rate is not the only determinant of exports. The income level of your export partner is equally important. The pace of growth of the European Union has been decreasing. In 2011, the Eurozone economy grew by 1.6 percent and the Eurozone economy is expected to shrink by 0.5 percent in 2012. The signs of contraction are already around and this is reflected negatively on Turkey’s exports in Euro terms.

Import of investment goods increased at a high pace annually starting with the mid-2010 to the last quarter of 2011. The rising tension in financial markets with the second half of the year and the hike in interest and exchange rates were translated directly on the importation of investment goods, the annual pace of increase of which started to diminish. Importation of investment goods have been decreasing for the last three months when three-month cumulative figures are considered.

The drop in exports in Euro terms and in the pace of annual increase of investment good imports validate that Turkey’s growth rate has been decreasing, which already was the most-likely estimate. It was almost unanimously accepted that the high growth rates achieved in 2010 and 2011 would soon vanish. The discussion was rather about what the magnitude of the drop would be following the 8 percent growth expected to be achieved by the end of 2011.

With the weakening of the international risk appetite along with the bad news spreading from the European Union during the second half of 2011, pessimism grew again. Back then, forecasts for Turkey’s 2012 growth were also sluggish. The official estimate at 4 percent was the most optimistic one while more critical accounts estimated 2012 growth to be zero. I expected 2010 growth to be between 1 and 3 percent, as I noted several times in my commentaries. Then, particularly after the interventions by the European Central Bank, liquidity became ample and risk appetite strengthened. Simultaneously, growth estimates were revised upwards with a more optimistic perspective. The liquidity injections of course did not solve problems; but saved time for a solution. Lately, however, the mood of the international markets got down once again. These have repercussions on Turkey, as well. Between mid-January and March 21, the Central Bank of Turkey (CBT) kept the short term interest rate at 7.5 percent. The rate currently reached 10 percent. In a few weeks before the rise, the value of the exchange rate basket increased from ¨2.02 to ¨2.12. Despite the 2.5 point increase in interest rates, the value of the basket is reluctantly floating around ¨2.08, which proves that the pessimism is spreading across markets.

And a note: If you were of the opinion that the CBT did not change the interest rate in its latest Monetary Policy Council meeting, please check the above interest rate figures once again. I will address this later if I have the opportunity.

Graph 1. Annual change in Euro exports, March 2008 - February 2011 (% change in three-month cumulative figures)

This commentary was published in Radikal daily on 31.03.2012