Is the system more transparent now?

The rate regarded by markets currently as the policy rate is the funding cost, not the one that the CBT calls as the policy rate.

Before 29 November 2012, the Central Bank of Turkey (CBT) used to decide the bank lending rate during Monetary Policy Committee meetings. The rate was kept constant between two Committee meetings and if the Committee decided to preserve the rate, banks were able to enjoy the same interest rate on borrowing for a long period of time. This borrowing rate was the one regarded by markets and therefore was called the “policy rate.” For example, between 10 May 2010 and 28 November 2011, the policy rate equaled the one-week repo auctions rate. I said this was the case until 28 November 2011, but according to the CBT, this still is the policy rate.

Here is a quotation from the first inflation report of the CBT: “...high price adjustments in administered products in October caused a more-than-anticipated rise in short-term inflation. In order to prevent deterioration in inflation expectations, the CBRT has delivered an important tightening in monetary policy since October. Accordingly, the interest rate corridor was widened upwards and the average funding cost was raised significantly by adjusting the amount of TL funding through 1-week repo auctions, when deemed necessary.”

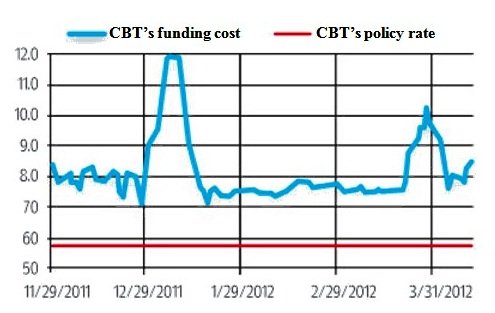

Please pay attention: what the CBT calls the “funding cost” is the interest rate on the short term lending to banks. Since 29 November 2011, the funding cost that the CBT calls as the “policy rate” floats significantly above the one-week repo rate. Figure 1 shows how the two rates changed since 29 November 2011. The unstable curve represents the rate called the “funding cost” and the flat line below represents the “policy rate.”

So, which is the CBT rate that is regarded by the markets currently? I think for the recent period, the answer would be the “funding cost” not the rate that the CBT calls as the policy rate. So, let us distinguish between “what the CBT considers as the policy rate” and “what markets consider as the policy rate.”

During the “implicit inflation targeting” period (between January 2002 and December 2005) when inflation rate was lowered from 68.5 to 7.7 percent, there was the common belief that the monetary policy decisions were not transparent and were mainly made by a single person. The regime implemented back then was called “implicit” and was not disclosed to public mainly because the Monetary Policy Committee did not directly decide on the interest rate and mainly focused on the inflation rate. The interest rate decision could be made in any meeting attended by the governor, deputy governor and relevant department heads and experts and upon the advices of the Committee. Therefore, date of meetings during which interest rates would be decided were not known by the public. Yet, the rationales of all interest rate decisions were announced. Furthermore, the CBT was called into account by the Board of Ministers and the Budget and Planning Commission of the Parliament twice a year. In short, the reason why the inflation targeting regime was called “implicit” was that interest rate decisions were not made by the Monetary Policy Committee and the schedule was not declared in advance. Concerning “what the CBT considers as the policy rate” we know when and by whom the interest rate decisions are made. But does this apply also for the rate that the markets consider as the policy rate, the rate that the CBT refers to on the second page of the report in the context of the method of monetary tightening?

Figure 1. The rate the CBT considers as the policy rate and the interest on the CBT lending to banks (funding cost): 29 November 2011–12 April 2012 (%)

This commentary was published in Radikal daily on 14.04.2012