A long way to go

For the consumer price inflation to decrease to 5 percent, headline inflation must decrease to 3 percent.

I want to continue with inflation dynamics from where I left on Thursday. Some of you might think that in the week when we learned that growth performance was way below the potential, two commentaries on inflation is too much. But it is not. The fall in inflation is not necessarily counter to growth. This is supported by many academic studies. But I will just present some figures today. Annual inflation rates in Turkey were 8.8 percent in 2007; 8.9 percent in 2010, and 8.9 percent in 2012. Respective annual growth rates were 4.7 percent, 9.2 percent and 2.2 percent. In the studied years, average inflation was almost the same while growth rates were diverse: Growth was close to the potential in 2007, way below it in 2012 and substantially above it in 2010. Hence, I will switch to the inflation without guilt.

The last time I compared inflation in Turkey with the emerging market economies, which the Central Bank on several reports refers to for exchange rate comparisons. Last week Central Bank Governor delivered a presentation in Mardin. The tables and charts used in his presentation are available at the Bank’s website. The exchange rate comparison is on page 29, but this time the countries in the list of emerging market economies are different. The list also includes developing countries with current account deficits. It excludes S. Korea and Hungary and adds Romania on the list. But the result is the same: Turkey had the highest average inflation between the mid-2010 and February 2013, with 21.9 percent compared to the group average at 12.4 percent. And Turkey’s score also is involved in the average. Turkey is followed by Brazil, which has a 4.5-points lower average inflation.

My focus here is that the difference between consumer price inflation and headline inflation was persistent. The former has been higher than the latter for a long time now. I raised this issue some years ago. If headline inflation is an indicator of the main trend in inflation, the gap should be narrowing down within a sufficiently long timeframe. In other words, the difference between the consumer price inflation and headline inflation is expected to fluctuate around zero.

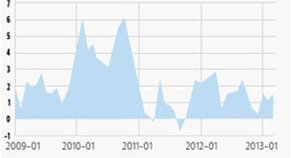

This was not the case in Turkey, however. The figure below shows the change in the difference between annual consumer price inflation and annual headline inflation measured with the l index. The chart starts with 2009, but nothing changes if we take the analysis, say, from 2006. Annual consumer price inflation over the examined period averaged 7.5 percent, compared to average annual headline inflation at 5.4 percent.

Over the last five months, headline inflation was stable at 5.8 percent. Based on the evidence from earlier figures which can be expected to give insights about the future, we can definitely conclude that for consumer price inflation to settle at 5 percent, headline inflation must decrease to 3 percent. Yet, we are far from that point.

Figure 1: Difference between annual CPI inflation and headline inflation, January 2009 – March 2013 (percentage points)

Source: Turkish Statistical Institute

This commentary was published in Radikal daily on 06.04.2013