It all started in 2010

Countries which become more unbalanced in an age of declining global imbalances are called vulnerable.

It was quite some time ago, in the first years of the twenty-first century, at a meeting in Rome on global imbalances. Henry Kissinger, the former secretary of state of the US, was in attendance. The popular question was how long the Chinese would continue to finance the high current account deficit of the US. There was an infirm balance, which was not sustainable. A financial crisis in the US was inevitable. It was a casual, brain-storming event where the mavens of the issue discussed prospects and possibilities.

Back then, it was an unfamiliar platform of debate for Turkey. I remember I got a lot out of the meeting. And I think it is this perspective we have to apply when we are assessing what the world has been facing since the start of the 2008 global crisis. Of course, events have not turned out exactly as they were discussed in that meeting. We were told by Lenin as in our youth that theory is grey when compared to the colors of life. But the fog seems to be lifting now. Today, we are in a better position to assess what has happened after the global economic crisis; a pattern is emerging. Time will show us whether this pattern will prevail or not; but a pattern exists. Let me tell you what I see and what it means for Turkey.

The world economy has entered a different age. Before the 2008 crisis, global imbalance was the rule. The US had a current account deficit of more than five percent in proportion to its GDP, whereas China had around nine percent of current account surplus. Americans used to spend their present and future income without thought; the savings rate declined from ten percent in the 1950s to two to three percent. The Chinese, meanwhile, were saving non-stop, with a domestic savings rate of more than 30 percent. China financed the US deficit. China’s savings were invested in US treasury bonds and deposited in the US, and in the absence of the rule of law, American investors were freely investing in China. When the savings were deposited in the US, the rules of the American courts were applied. We all knew that this system could work only temporarily. China was just playing along, in line with Deng’s slogan “hide your brightness, bide your time.”

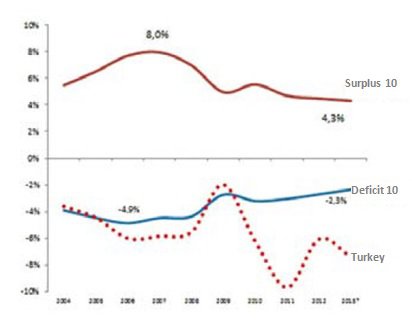

Chart: How do current account imbalances decline? Cumulative current account deficits and surpluses of top ten surplus and deficit countries and Turkey’s current account balance (as % of GDP)

Source: IMF

What does the chart show?

Then the global crisis has hit. The US deficit shrunk from 5.8 percent in 2006 to 2.8 percent in 2013. Americans started to save in order to pay their debts. Domestic savings rate exceeded four percent, accordingly. Due to the decline in the US demand, China’s current account surplus decreased from 8.5 in 2006 to 2.8 percent in 2012. There is less macroeconomic imbalance in the world now. The chart below shows the current account balances in the top ten deficit and top ten surplus countries in proportion to their respective GDPs. The top ten surplus countries are China, Germany, Japan, Saudi Arabia, Russia, Netherlands, Norway, Singapore, Sweden, and Switzerland. The top ten deficit countries are the US, Spain, the UK, Australia, Greece, Turkey, Italy, Poland, France, and Portugal. The pattern here is that both surpluses and deficits are declining. The world economy is assuming a new balance. Current accounts, which are the source of global financial imbalances, have started to find their balance. Does this pattern hold for the entire world? No. Current account deficit in proportion to GDP has been increasing systematically since 2010 in Turkey; it seems that Turkey has missed the change of tide.

I believe this chart tells us why the Turkish economy is the way it is today. That is indeed a common feature of the economies known to be vulnerable: countries which become more unbalanced in an age of declining global imbalances are called vulnerable. I don’t think this story will end here. I believe that ahead of us is a new age of fewer opportunities for international financial flows. The emerging change in patterns might be a permanent shift rather than a temporary post-crisis movement. If so, Turkey needs more adjustment and more structural reforms. Just mark my words.

This commentary was published in Radikal daily on 14.01.2013