Foreign fund story of the two crises

I will continue with the comparison of 2001 crisis and the global crisis. Previously I compared the two in terms of unemployment, inflation, and production. Unemployment rate increased during both. In the 2001 crisis unemployment rate rose by 3.5 point to 10.5 percent compared to the previous period. The rate jumped to 14 percent level in this crisis. Unemployment rate increased by the same amount, though to a higher level in the latter. The movements in the GDP were also similar in case of both crisis. The time period from the peak before the crisis to the trough after the crisis was the same in case of both crises. The period and style of recovery also seems similar. On the other hand, production loss between the peak and the trough was larger in the global crisis.

In the case of the global crisis, one factor that led to major drops in production and rises in unemployment was the fact that the debt repayments by banks and firms exceeded the foreign funds they received. Foreign debt repayment figures for February are announced. Table 1 shows both the annual sums and the changes over the last seven months. Negative values imply that the amount repaid exceeds the amount of newly received foreign funds.

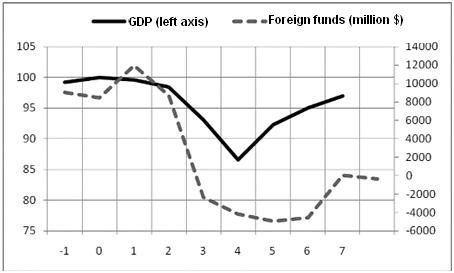

When a comparison is made between 2008 and 2009, the impact of the global crisis is seen clearly. In 2008, in the final months of which the impact of the crisis was already felt, net foreign borrowing was $26.7 billion whereas $13.7 billion net foreign debt repayment was made in 2009. There is a $40 billion difference. It is doubtless that this affected the volume of economic activities and forced firms to downsizing. But the interesting part is that this phenomenon prevailed as well in the first two months of 2010. It is seen that foreign fund usage did not have a role in the recent recovery.

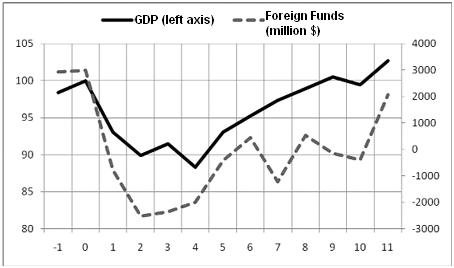

Is this phenomenon a unique characteristic of the last crisis? Figure 1 and 2 indicate that the answer is no. Figure 1 shows the foreign fund movements between the peak of the GDP before the 2001 crisis (last quarter of 2000) and the time when the peak was re-achieved after the crisis (first three quarters of 2003). These values are in million dollar terms and correspond to the share of the particular period in the total value. The same figure also gives the normalized GDP movements where the peak level at the end of 2000 corresponds to 100.

Figure 2 gives the movements in the two variables during the global crisis. The peak level of GDP before the crisis is achieved in the first quarter of 2008. The bold lines give the GDP and dotted lines give the net foreign funds in each figure. Level of foreign funds is measures in the right axis. '0' in the horizontal axis correspond to the peak GDP level. The meaning of other numbers is also clear. For instance, the number '2' show two quarters after the peak of the GDP.

Foreign fund inflows tighten rapidly in both crises. It takes a considerable time before the amount of foreign funds received exceed the amount of debt repayment, i.e. before the net foreign funds become positive. In the 2001 crisis, it took five quarters to cease being a net foreign debt re-payer. Then fund flows float. In the global crisis, recovery takes place in the seventh quarter (last quarter of 2009). The last observation in Figure 2 corresponds to the last two months of 2010, for which a turn to negative is seen. In the first crisis, level of foreign fund inflows hit the trough before the GDP did. In the global crisis, the situation is just the opposite.

Despite this difference it can be said that the movements in foreign fund flows are roughly similar. On the other hand, I would like to draw your attention to the U-turn in the last crisis when only the amounts are considered. In addition, we should keep in mind that the global crisis also affected seriously developed countries which provided funds for Turkey. This signals that the recovery of foreign fund flows might take a longer time compared to the 2001 crisis. If happens, such a development will have adverse effects on growth rate and employment.

Figure 1: Net foreign funds banks and firms received and GDP during the 2001 crisis (from the 4th quarter of 2000 to the 3rd quarter of 2003)

Figure 2: Net foreign funds banks and firms received and GDP during the global crisis (from the 1st quarter of 2008 to the 1st quarter of 2010)

Table 1: Net foreign borrowing by banks and firms ($ millions)

|

|

Banks |

Firms |

|

||

|

|

Total |

Long term |

Total |

Long term |

Total |

|

Annual 2004 2005 2006 2007 2008 2009

August 2009 September October November December January 2010 February

|

5708 9248 5814 5608 3047 -4129

-574 -493 -140 202 2179 -1052 35 |

2361 6544 9766 7271 724 -1340

-308 313 197 90 342 -97 -353 |

5106 9875 18812 25888 23680 -9539

-1741 1169 -1151 -1044 -25 -988 -518

|

4765 9508 18123 25674 22746 -9318

-1881 -1061 -1109 -948 5 -1086 -606 |

10814 19123 24626 31496 26727 -13668

-2315 -1662 -1291 -842 2154 -2040 -482 |

This commentary was published in Radikal daily on 18.04.2010