Dual-character growth performance, again

Yesterday growth rate for the first quarter was announced. As expected gross domestic product (GDP) increased significantly compared to the same period in the year before by 117 percent. The rat for the previous quarter was 6 percent. Thus, the economy has been growing for the last two quarters, which is pleasing.

The details of the growth story are also an issue of concern. The story goes like this: private consumption expenditures increased by 9.9 percent and public sector investment expenditures increased by 22.1 percent. Particularly the rise in investment expenditures is quite striking. For the first time over a long period private sector investment expenditures went up compared to the year before.

Private sector investments had increased in the first quarter of 2008 for the last time. This also is a pleasing development. So, did we achieve back the performance before the global crisis? The answer to this question is of critical importance. Let me address the recent developments in two different aspects in order to figure the answer out.

Table 1 shows the growth rate of GDP and some sub-items in the first quarter compared to the first quarters of 2008 and 2009. First quarter of 2008 signifies the period where peak GDP level before the global crisis was achieved. This is why I involve the period in the comparison.

Table 1: Growth rates (%)

|

|

2010.I/2009.I |

2010.I/2008.I |

|

GDP |

11.7 |

-4.5 |

|

Private consumption |

9.9 |

-1.2 |

|

Private investment |

22.1 |

-17.2 |

|

Industrial value added |

18.8 |

-6.2 |

|

Industrial production index |

17.3 |

-8.5 |

The values at the last column of the table imply that the answer to the question is no. Growth rate for the first quarter of 2010 is still negative compared to the first quarter of 2008. In short, we could not achieve the pre-crisis peak level yet. Private investments in particular are still quite low compared to the said period.

Therefore, we are faced with a dual-character growth performance following us for a long time. But this also is normal; after all the economy is recovering from a deep crisis which cannot happen overnight.

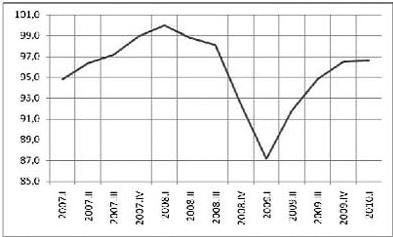

Another way to present the dual-character of the growth performance by examining the change in GDP values net of seasonality and calendar effect. Graph 1 shows the change in GDP net of the mentioned factors since 2007. I adjusted the values where value of GDP for the first quarter of 2008 is 100 to make interpretation easy.

The graph, like the table, indicates that we still have progress to make to reach the peak level. In addition, it appears that in this quarter the economy did not grow substantially compared to the quarter before; there exists a rise by 0.16 percent.

In the last commentary, I drew attention to the difference between rate of growth of the value added in industrial sector as a sub-item of GDP and of industrial production index announced monthly and said that the difference has been widening since the second quarter of 2009. The divergence was in favor of GDP: from March 2006 to March 2009, the difference varied between -1.8 and 1.9 percent. However, for the last three quarters of 2009, the difference widened also in favor of GDP: pace of growth of industrial value added is much higher than that of industrial production index: 4, 3.7 and 2.4 points, respectively. Looking at the last two rows in Table 1 we can apply the comparison to the first quarter of 2010. Though the values are not as high, there is a difference by 1.5 points in favor of GDP. We should also not that this phenomenon prevailed over the last seven quarters. I will skip the possible reasons as I already discussed them with the previous commentary.

Graph 1: GDP net of seasonality and calendar effect: 2007 first quarter - 2010 first quarter (2008 first quarter = 100)

This commentary was published in Radikal daily on 01.07.2010