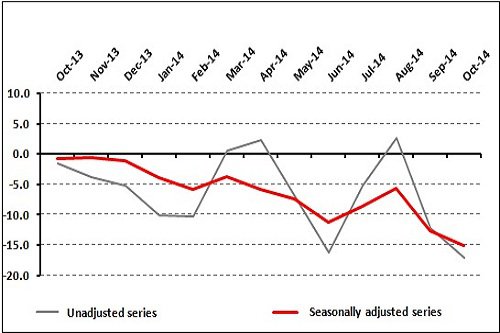

Retail Confidence Slumps at the Start of the Last Quarter TEPE which had moved up in July and August had a value of -15 in October

In October 2014, TEPE declined month-on-month by 2.4 points and year-on-year by 14.3 points. Sales expectations weakened in both terms while anticipation for business recovery improved month-on-month. All sub-sectors of the retail industry worsened year-on-year. Retail confidence in the EU is also in decline for five consecutive months. Alike the trend in overall Turkey, Konya’s retail confidence index declined both year-on-year and month-on-month.

TEPE which had moved up in July and August had a value of -15 in October, declining month-on-month by 2.4 points and year-on-year by 14.3 points. The decline was driven by the weakening of business volume compared to past 3 months and of sales expectations in the next 3 months.

Having turned down in September after the surge in July and August, the decline in sales expectations continued in October. The balance value of the expectations in the next 3 months was 9.1. Sales expectations for the next 3 months declined year-on-year by 7.8 points and month-on-month by 0.6 points.

In October 2014, 24.4 percent of TEPE survey participants declared that they expected business activities to improve in the next 3 months while 41.7 percent expect business activities to decline. 33.9 percent of the participants do not expect business activities.

The balance value of the volume of business activities compared to the same month in the year before had a value of -36.4 in October 2014. Business volume compared to the year before increased by 12.8 points compared to September 2014 and declined by 10.4 points compared to October 2013.

In October 2014, 21.2 percent of TEPE survey participants declared an improvement in their business activities compared to the year before while 52 percent declared deterioration. 26.8 percent of the participants declared that business activities did not change compared to October 2013.

All subsectors declined compared to October 2013. The mildest decline was in food, beverages, and tobacco products and motor vehicles sectors. These were followed by non-specialized stores and electrical appliances, radio, and televisions sectors. The decline was smaller than the average in the abovementioned four sectors. Textile, ready-made clothing and footwear, “others” (gas station, pharmacy, perfumery, hardware, glassware, stationery etc), and furniture, lighting equipment, and household articles sectors declined at a rate above the average, with the latter suffering the sharpest year-on-year decline.

Question-based assessment of the TEPE survey results suggests that compared to September 2014, all indicators declined except for the volume of business activities compared to past year and the expectation for the number of stores in the next year. Compared to October 2013, all conditions declined expect for the expectations for sales prices in the next 3 months and the number of stores in the next year.

The EU-28 Retail Confidence Index had a value of -2.5 in October 2014, declining month-on-month by 0.7 points and year-on-year by 1.6 points. This is the fifth consecutive month the EU-28 index has been in decline. Turkey performed worse than the EU-28 and the Eurozone compared to both October 2013 and September 2014. Also, Turkey had the second sharpest year-on-year decline in retail confidence across the EU-28.

As was in September, Greece had the highest year-on-year improvement in retail confidence across the EU-28, and was followed by the Netherlands, Sweden, and Slovakia. The United Kingdom, Turkey, Finland, Bulgaria, and Germany declined year-on-year. Compared to September 2014, Slovenia had the largest improvement in retail confidence. The EU-28 Retail Confidence index was weaker than the Eurozone index concerning year-on-year and month-on-month figures both.

Retail confidence down also in Konya

In the context of the Konya Province Retail Confidence Index (KOPE) carried out in cooperation by Konya Chamber of Commerce (KTO) and the Economic Policy Research Foundation of Turkey (TEPAV), face-to-face interviews with 300 retailers from Konya have been carried out on a monthly basis since February 2012.

In October, KOPE had a value of -3.8 compared to TEPE at -17.2. KOPE, which had broken the series in the positives since June in September remained in the negatives in October. KOPE declined by 7 points year-on-year and by 3.2 points month-on-month. Konya’s retail sector performer better than overall Turkey and EU-28. The year-on-year decline in KOPE was driven by weaker business volume compared to past 3 months and weaker expectations for sales in the next 3 months.

The anticipation for business recovery compared to past 3 months declined year-on-year while expectations for sales and employment in the future declined on both timeframes.