TEPAV Articles

- [Archive]

IMF’s unpleasant birthday present for the “new” monetary policy 08/12/2011 - Viewed 3509 times

The Central Bank of the Republic of Turkey (CBT) is trying to deal with bad news coming with domino effect lately. The latest surprise (!) was made by the International Monetary Fund (IMF), yesterday. The staff report for the Article IV consultation by the IMF focused on monetary policy, thus, the CBT. The report criticized the CBT as follows:

“With a tighter fiscal stance and appropriate macroprudential policies in place, they [directors] saw scope for cautiously raising the single policy interest rate, taking into consideration the possible impact on economic growth and capital flows. Directors recommended moving toward a more transparent and consistent monetary policy framework to re-anchor inflation expectations and avoid excessively rapid disintermediation. Narrowing the inflation tolerance band and gradually lowering the inflation target will help moderate the impact of future capital flow cycles.”

This harsh statement validates that there exists a severe problem. In fact, this is not the first surprise. Another came from Fitch about two weeks ago. This was unexpected, at least for the majority of market actors.

Right after the Monetary Policy Committee declared in November that policy rate will be kept constant, Fitch affirmed Turkey’s credit rating at BB+ but cut the rating outlook from ‘positive’ to ‘stable’. In other words, it conveyed the message “You’d better not get to enthusiastic!” to those who expected an investment grade. Fitch declared that inflation was considerably high and more volatile compared with countries rated “BB” and estimated that 2011 inflation would stand at 9.2 percent high above the CBT target at 5.5 percent. In other words, Fitch exerted their dissatisfaction with the CBT’s monetary policy.

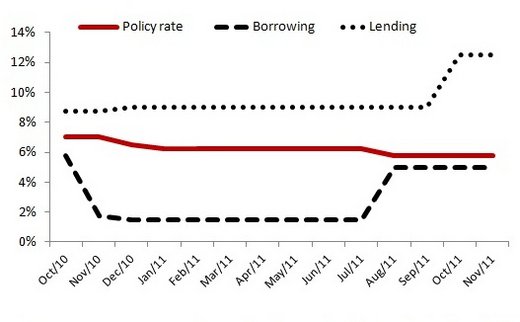

These remarks are quite meaningful given the timing. The “new” monetary policy framework was presented in November 2010 (Figure 1). With a decision dated November 1, 2010, the Monetary Policy Committee rapidly widened the interest rate corridor and initiated the series of interventions that pushed reserve requirements up. In the following months, policy rate cuts took place. It is now the first anniversary of the new monetary policy framework. In these days when the “new” policy framework was getting prepared to celebrate its birthday and to pride on the policy innovations, unpleasant birthday presents stared to come in. This makes me think, “What a pity to take the winds out of the CBT’s sails.”

Figure 1. Interest policy of the Central Bank for the last year

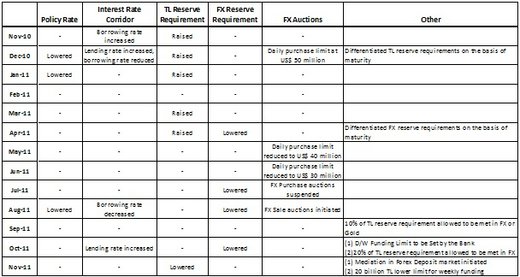

If you are wondering why everyone turned so critical about the CBT’s policies, the table below successfully summarizes the picture (Table 1).

Table 1. Policy Basket of the Central Bank for the last year

Source: CBT

Criticisms against the CBT can be grouped under four categories:

- Multiple policy changes in more than one policy areas: According to the above table, there were 29 main policy changes introduced during the last year. That corresponds to 2.2 changes per month on average. Daily or interim decisions are not included here. If monetary policy decisions are grouped under six categories namely policy rate, interest rate corridor, TL/FX reserve requirements, FX auctions and others, it is seen that the highest number of changes was introduced with respect to reserve requirements for TL deposits. This was followed by FX auctions and reserve requirements for FX deposits.

- Inconsistency between policies implemented in the same period: Inconsistencies were as an important problem as the high number of decisions. The CBT occasionally took expansionary and contractionary monetary policy decisions in a single period which raised anxiety in markets about the net direction of the policy. For example, in December 2010, the CBT loosened monetary policy by reducing the policy rate and initiating FX purchase auctions on the one hand, but tightened the policy via widening the interest rate corridor and raising TL reserve requirements on the other. The net impact was indefinite. The CBT argued that the net impact will be tightening but failed to convince markets. Given the rapid expansion in economic activity, current account deficit and credit supply during the first half of 2011, it would not be fair to argue that markets were wrong to criticize the CBT.

- 3. Inconsistency between policies implemented in the same policy area: The contradiction between policies implemented in the same period is not the only source of inconsistency. Decisions in the same policy area were reversed in just one year, which can be considered a short period with respect to monetary policy that gives results with a certain time lag. This weakened the ability of market actors to adapt and protect themselves against potential risks. We are witnessing contradictory decisions concerning interest rate corridor, reserve requirements and FX auctions. Following the deepening of the European crisis in summer, U-turns were observed in almost all policy areas. The CBT maintains that this shift stemmed from the rapid changes in international circumstances. Still, it fails to convince market actors. With the words of market actors, “The CBT acts like a captain who snubs the sails as the storm approaches.” This raises the question, “If you do not know from which direction the storm will hit, why not shorten the sails?”

- 4. “Policy rate will not be changed” approach: Another issue that disturbs the markets is that the CBT, who had revised all policy decisions and introduced new ones, acts reluctantly when it comes to change the policy rate. As table 1 reveals, only a few changes in the same direction were introduced concerning the policy rate. In fact, the decision that overnight (at 12.5% interest) and weekly (at 5.75% interest) lending limits will be set on a daily basis was read as “Increasing the policy rate without directly increasing it.” This was perceived as lack of independence of the CBT in terms of using the policy rate as an effective policy tool. This “Do not say the P word!” approach across the CBT management harms the credibility of the bank.

As summarized above, the new policy framework of the CBT has been criticized by market actors and experts under four main headings. Nevertheless, the straightforward and harsh criticisms raised lately by Fitch and the IMF validate that the “new” monetary policy does not give confidence at the end of its first year.

Then, the million-dollar question is how the mentioned policies that raised anxiety among market actors have been affecting Turkey in comparison with prominent markets. Did Turkey perform better or worse than others? This question will be handled in detail in the next commentary. To give a hint, it is not a pretty sight!