TEPAV Articles

- [Archive]

Turkey’s main problem is that it does not have a medium-term growth story 01/02/2010 - Viewed 6405 times

We are about to leave behind the first decade of the second millennia A.D. We have more data to review the last decade with respect to economic performance. How do you think that the 2000's will be remembered in the future? Could Turkey write a success story in terms of economic performance over the last decade? This commentary involves a short review in the framework of these questions. After a short assessment of 1980's, 1990's and 2000's and stating five main point, I will try to voice some wishes on how 2010's will be.

The outline of the Turkey's recent economic story is obvious. Having launched the process of rapid economic liberalization and integration with the world in 1980's, Turkey does not recall 1990's a favorable decade also due to the impact of economic and political instability. This instability is known to have ended with the 2001 crisis. The stability program successfully implemented after the 2001 crisis and the macroeconomic stability ensured as a result; the strengthening of European Union membership perspective, billions of dollars of foreign investment attracted, and high-pace growth are the first things to highlight for the first half of the 2000's. However, the story for the period after is more disputed; it is hard to talk about a consensus on how the second five years of 2000's was.

When comparing these three periods, we can focus on a number of indicators; and we will see such research frequently in the future. Today let us take the pace of real GNP growth, i.e. rate of economic growth, which is the most important indicator to reveal how the gap between Turkey and developed countries close, as the main criterion. As known by everyone, we have a certain consensus on the growth rate of 2009 and a rough agreement on the growth estimates for 2010 which varies by +/-1 point. Therefore, it is possible to evaluate the first decade of 2000's in terms of economic growth performance in comparison with the performance achieved in previous years.

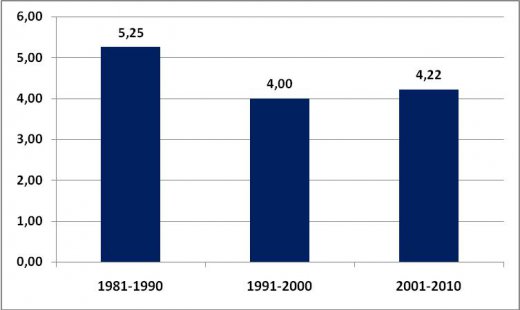

The figure below shows the average annual growth rates over three different decades. Considering the growth performance, the first thing that grabs attention is that the 2000's lagged behind 1980's while no significant change is observed in 1990's. The first point of this commentary can be a bit bitter, but 2000's prove not much different than 1990's, which were called as 'lost years' with respect to growth performance. Although the fall in growth rate along with the rise in GDP level can be considered as something natural, it is not possible to say that an average economic growth performance of 4% is satisfactory for Turkey. The reason for this is quite apparent: the problem of generating employment. Calculations made by TEPAV reveal that in order to maintain the existing level of unemployment, Turkey should ensure a minimum growth rate of 4.3 percent. Taking the 700 thousand young people joining the labor force each year and the millions of women who are still out of the labor force, the growth rate to be sustained reaches as high as 6-7 percent. In short, despite the improvements in many indicators 2000's appear to have been far from satisfactory in social terms. One significant indicator for this is the 16.4 percent non-agricultural and 24% young population unemployment.

Figure 1: Annual Average Rate of Increase in Real GNP Growth Rate for Three Different Periods in Turkey: 1981-1990, 1991-2000, and 2001-2010

Source: TURKSTAT, Turkish Data Monitor, TEPAV calculations

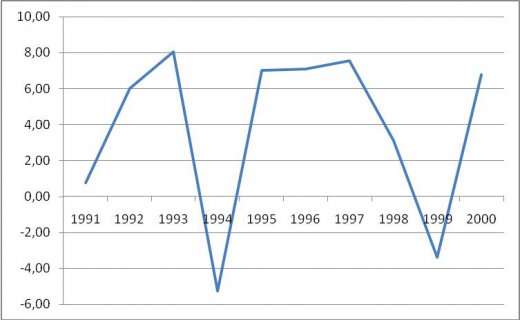

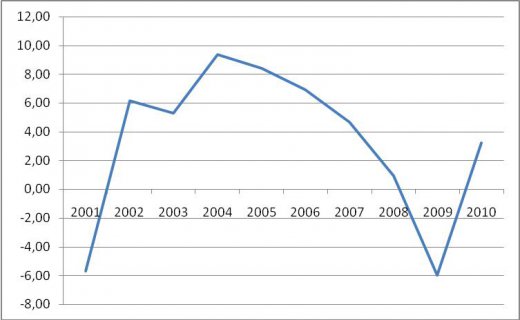

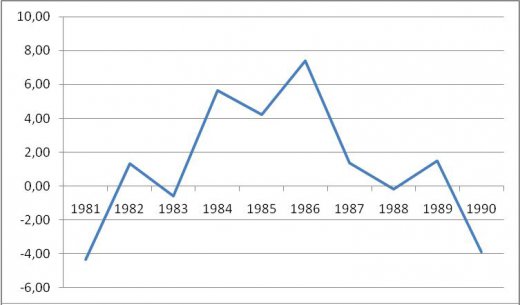

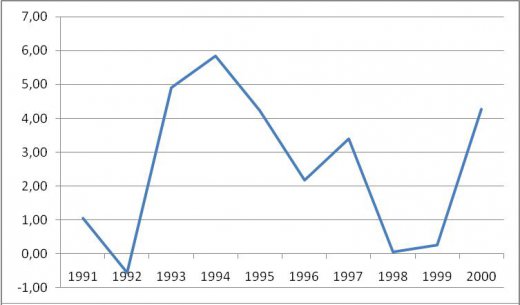

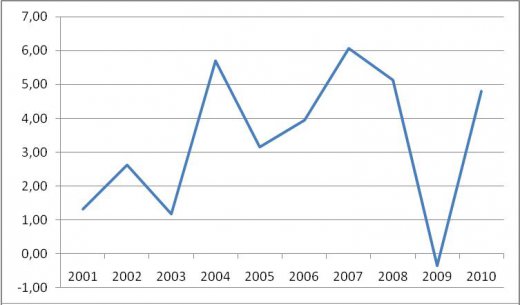

The graphs analyzing the indicators separately for each of the examined period can be seen below (Figure 2, 3, and 4). Let us underline one point that comes apparent when assessed together. The economic growth curve for 1980's and 1990's have ups and downs while 2000's begin with a rapid drop followed by a rapid rise first and then a steady drop finalized with a harsh trough with the 2008-2009 global crisis. Here, the point to note is that growth in 2000's was steadier compared to the previous two decades whereas a "steady drop" was observed from 2004 to 2009. We believe that this point implies that the economic recession encountered in 2009 stems not only from the global crisis but also from the "endogenous" factors.

Figure 2: Annual Real GNP Growth Rates: Turkey, 1981-1990

Figure 3: Annual Real GNP Growth Rates: Turkey, 1991-2000

Figure 4: Annual Real GNP Growth Rates: Turkey, 2001-2010

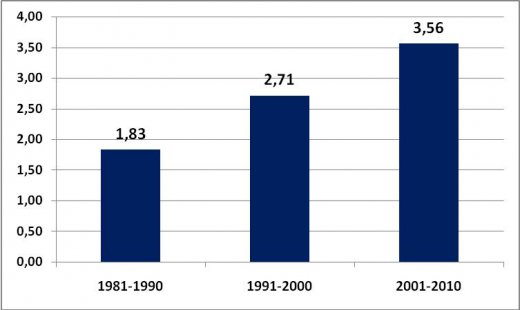

Let us state the third point by comparing the growth adventure of Turkey over the last three decades with another country. But different than the previous TEPAV reports which usually make comparisons with South Korea, a country which has converged significantly to developed countries beginning with 1960's, let us take a look at the performance of Brazil, which has a similar structure of economic discipline and maybe culture to Turkey this time. Figure 5 below is the Figure 1 revised for Brazil; it shows the economic growth date for Brazil separately for the last three decades. The first striking point is that growth rates tend to increase rapidly. In Brazil each decade was more fruitful than the preceding one. So this is the first factor distinguishing Brazil from Turkey. The second factor is that, though Brazil has overcome the ill fate and improved average growth relatively in 2000's, the average growth performance over the last decade stands below Turkey with 3.56 percent.

Figure 5: Annual Average Rate of Increase in Real GNP Growth Rate for Three Different Periods: 1981-1990, 1991-2000, and 2001-2010

Source: Economist Intelligence Unit

Let us deepen the third point with a third finding and take a look at the annual growth rates in Brazil for each decade. Figure 6-7-8 modifies the Figure 2-3-4 for Brazil. 1980's were full of ups and downs also in Brazil. In this decade, an advance of three years was followed by deterioration of four years. 1990's in Brazil on the other hand show a trend similar to that in Turkey over the mentioned period: first a leap, then a fall. The striking point comes with 2000's. Brazil enjoyed a steady increase in growth performance in the 2003-2008 period whereas the global crisis reduced the economic growth down to 0. Brazil, who benefited from the increase in commodity and oil prices before the crisis, managed to avoid economic contraction even in the midst of the crisis. It also appears that the country will attain solid recovery in 2010. At this point the background of the long term and sustainable growth story of Brazil should also be noted. The success in fighting the inequality in income distribution, establishment of a policy framework tailored to increase the share of the middle class in economy, as well as the ability to maintain macroeconomic stability and improve the competitiveness of the economy are achievements that attract attention. At the background of the macroeconomic stability stands the implementation of a fiscal responsibility law which can set an example for many countries. The fact that Brazil has a say in the world markets in agricultural and mining sectors while holding a significant comparative advantage in high-technology industrial branches such as submarine and airplane production is another factor differentiating between Brazil and Turkey.

Figure 6: Annual Real GNP Growth Rates: Brazil, 1981-1990

Figure 7: Annual Real GNP Growth Rates: Brazil, 1991-2000

Figure 8: Annual Real GNP Growth Rates: Brazil, 2001-2010

Taking departure from these five points, we can automatically reach a conclusion on what Turkey should do in order to ensure that 2010's will be more favorable times than 2000's. Just like Brazil, Turkey immediately needs a strategy and a story. The main theme of the story shall be how to improve growth rate from 4 to 6-7 percent. Particularly since liquidity will not be abundant in the coming period as was in 2000's and since Turkey needs foreign savings to grow, Turkey should have a story which will distinguish the country from other countries rivaled to attract foreign funds.

Then, what should be the growth story of Turkey? Though this can be assessed in another commentary, we would like to finish by addressing some elements that should definitely be involved in Turkey's story. First element is a new and healthy fiscal discipline framework which will facilitate the achievement of a steady growth despite low domestic savings. A fiscal structure that is faced with the risk of disruption in the eve of each election cycle can no longer support a steady growth process in the current milieu. In this respect, implementation of fiscal rule along with efficient sanctioning and responsibility mechanisms is one of the must elements of the story for the next period.

Second, a reform program that will push up the pace of productivity gains throughout the economy shall realistically guide the public. It is of great importance to implement the 'second generation reforms' TEPAV has been concentrating on for a long time in a number of policy areas under the rule of different institutions such as public administration, judiciary, tax system, access to finance, capital markets, health, education, and skill transformation; and to revise the institutional infrastructure of the economy to make it more suitable for increasing investments and the gains in employment in both quality and quantity.

Third, an industrial strategy and vision which will facilitate the shifts from unproductive to productive economic areas shall be adopted and implemented. An economic policy framework geared to support the transformation into a more innovative and higher-quality production and services structure not based on cheap labor will also contribute to the decisions on the content and direction of second generation economic reform process. At this point quoting from Daron Acemoğlu, MIT professor famous for his studies examining the relationship between economic growth and institutions will be useful:

"I see no reason why Turkey cannot grow by 5-6 percent in average over the three decades ahead. If achieves such an average, Turkey can jump from the developing countries category to developed countries category over the coming three decades just as South Korea did.

USA and Europe can never go beyond 2-3 percent average growth rate because there are no unproductive sectors in their economy. Since Turkey has unproductive sectors, it is possible that it ensures a more rapid growth through shifts from unproductive to productive sectors." (Radikal daily, January 25, 2010).

Let us hope that at the end of the year 2010, we will be evaluating a growth story that proved successful. Concentrating on the actual priorities in 2010 and 2011 plays great importance in this respect.