Commentaries

Fatih Özatay, PhD - [Archive]

Once again on confidence 05/04/2009 - Viewed 1912 times

We all know that among the main determinants of consumer and investor behaviors are the confidence in the future of the economy. It is both what economics theory says and what we observe in things going around us. The same result is also observed if the things going on around us are examined in a text book style utilizing some technical models. Confidence is a significant determinant of private sector investments. Applied studies show that, in such environments, 'let us wait and see, the we do what is necessary' type of approach is quite prevalent among consumers.

In this regard, measuring the level of confidence in the economy is of great importance. In Turkey there are indexes geared to fulfill this function. These indexes are monitored and the changes are announced to the public by the media. One of the mentioned confidence indexes is the real sector confidence index announced by the Central Bank. Here, let me put a footnote: (This index is being announced since December 1987. However, as the scope of the index was changed in December 2007, comparing old observations with new ones became problematic. Cannot the Central Bank publish this very important index in a form comparable with the old index?)

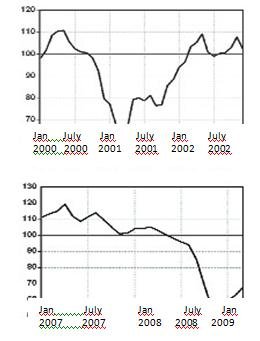

The lesson for Turkey to be learned out of previous crisis is that during crisis periods, the confidence in the economy deteriorates rapidly and plays a huge role in the intensification of the crisis through reducing spending. However, the opposite is also true. If a solid economic program cracking down the problems is implemented, confidence in economy recovers rapidly. Graph 1 shows the changes in real sector confidence index from January 2000 to December 2002. The values above 100 (horizontal line) shows a rise in confidence and those below 100 shows a fall in confidence. Rapid deterioration as well as rapid recovery can clearly be seen. There is no doubt that 'rapidness' is a relative concept; back then, 'rapid recovery' took 11-12 months. Recent changes in the index show that the confidence has been rapidly contracting and hitting the bottom (Graph 2).

Now, this is the question: If Turkey implements a solid economic program, can rapid recovery in confidence as was in 2001 be observed? The answer is partially yes, and partially no. 'Partially no' because as I underlined before for several times, a significant part of the fall in confidence is due to an exogenous factor. This exogenous factor recently shows positive developments but we cannot be sure of its permanency. The answer is 'partially yes' because the steps we take are also important.

Graph 1: Central Bank Real Sector Confidence Index (January 2000 - December 2002)

Graph 2: Central Bank Real Sector Confidence Index (January 2007 - March 2009)

This commentary was published in Radikal daily on 05.04.2009